Company Incorporation and Registration in Poland

- Company incorporation in Poland

- Limited Liability Company

- Joint-Stock Company

- Registered Partnership

- Limited Partnership

- Business Partnership

- Representation office in Poland

- Branch in Poland

- Subsidiary / SPV in Poland

- Shelf Company

- Opening Bank Account

Updated: 21.03.2024

Company Incorporation in Poland — how to start?

First step in the process of incorporating a company in Poland — you need to choose a legal form of your future Polish company. The selection is not too difficult, as there an uncontested leader amongst investors choice – the LLC – Limited Liability Company. Approximately 94% of foreign investments in Poland are carried out in the form of LLC.

Secondly, you need to decide on key features of your new company (name, share capital, representation rules, etc.). You may use our online company incorporation form which we provide upon first contact. If any legal advise is required at this stage – you may request consultation from one of our incorporation lawyers.

Thirdly, you will need to gather all necessary documents. However, often we will be able to do that for you. Selection of documents required for company formation depends whether you want to:

- invest directly (and become the shareholder of Polish Company in person) or

- invest indirectly, i.e. register a subsidiary in Poland (and become shareholder of Polish Company through your foreign company).

Compete list of required documents shall be determined with company registration attorney.

Finally, you will also need to decide whether to visit Poland to complete the company incorporation process or run the process remotely and entrust the company formation assignment to corporate Law Firm.

Why shall I register company Poland?

Polish Law provides variety of incentives for every investor who registers company in Poland. Incentives may be divided by different categories. Tax incentives are usually most interesting for the foreign investors:

- Low corporate taxation (CIT) at 9 % (for revenue up to 2 mln EUR) and 0 % of tax for profit retention (Estonian CIT),

- 5 % of tax for income derived from IP rights in Innovation Box scheme,

- Reseach and Development (R&D) tax relief allowing to increased deduction of eligible costs from tax base,

- investment in Special Economic Zones (SEZ) which provides corporate income tax exemption and property tax exemption.

In addition investors may benefit from features of Polish market:

- Number six biggest economy in European Union,

- Steadily growing GDP (5,3 % in 2022),

- Number five biggest consumer market in EU (38 mln Poles),

- Massive HR market, i.e. population in working age (approx. 25 mln Poles),

- Low unemployment rate at level of 5 % in 2023,

- Well developed educational system consisting of approx. 450 Universities and in total 1,3 mln of students,

- Location in Central Europe by EU boarder with well developed chain of motorways, 14 civil airports and 3rd biggest rail network in EU.

How to open company in Poland?

- Choose a legal from

- Gather required documents

- Visit Notary or register account in S24 system

- Sign the Articles of Association

- Submit registration motion to KRS (Polish Company Register)

- Open a bank account

Company Incorporation in Poland – Quick Facts for 2024

| Pre-registration name reservation | Not required. Available names may be verified with our legal counsels |

| Registration time? |

|

| Available registration methods? |

|

| Shareholding available to foreigners? | Yes, there are no restrictions as to nationality of the shareholders |

| Virtual offices permitted? | Yes, the company may be registered at virtual address |

| Local director required? | No, Board of Directors may be composed entirely of non-residents |

| Corporate tax rates (CIT) |

|

| Value added tax (VAT) |

|

| Tax incentives |

|

| Registration tax |

|

| Registration numbers |

|

| Incorporation / constitutional documents |

|

| Competent registration court |

|

| Corporate bank account opening |

|

| Electronic signature |

|

Which legal form of Polish Company shall I choose?

Foreign investors usually choose Polish corporate companies (LLC or JSC), rather than Polish partnerships. This is mainly to due to the fact that Polish corporate companies provide feature of liability limitation (of shareholders or stockholders), while in the partnerships the liability is unlimited. As mentioned above LLC are usually preferred forms of investment in Poland, nevertheless particular features of your project (e.g. regulatory reasons) may lead to different choices. For this reasons below we are presenting different types of companies so that you may explore to take an informed decisions about registration of your company in Poland.

Polish Corporate Companies:

- Polish Limited Liability Company (Sp. z .o.o)

- Polish Joint-stock Company (S.A)

Polish Partnerships:

- Polish Business Partnership (S.c.)

- Polish Registered Partnership (Sp.j.)

- Polish Limited Partnership (Sp.k.)

What documents do I need to incorporate company in Poland?

Scope of the documents may vary depending on company type and particular circumstances. However in order to incorporate company in Poland you will usually need:

- If you are private individual:

- ID or passport

- If you represent a foreign company intending to register subsidiary in Poland:

- excerpt from your local company registry with Apostille

- ID or passport

If you want to register company remotely, without visiting Poland, you may request our lawyers to represent you in the company formation process upon power of attorney. For that we will also need notarial power of attorney granted in your country of residence. Our Law Firm you provide you with ready made template of power of attorney for execution. Such power of attorney will need to be Apostilled or legalized.

Procedure to Register a Company in Poland

Creation and registration of the company in Poland consists of a series of corporate actions which need to be taken in compliance with Code of Commercial Companies in order for newly established company to be entered into the Polish Company Register (The National Court Register – KRS) – quite similar to the registers operating in other countries: e.g. UK: Company House; US – Delaware State: Division of Corporation.

Creation and registration of the company in Poland consists of a series of corporate actions which need to be taken in compliance with Code of Commercial Companies in order for newly established company to be entered into the Polish Company Register (The National Court Register – KRS) – quite similar to the registers operating in other countries: e.g. UK: Company House; US – Delaware State: Division of Corporation.

The process to register the company in Poland is be divided into certain stages, which we present below. However, we would like to underline that these stages relate to the traditional way of registering the limited liability company. Recently, LLC in Poland can be also registered online and this procedure slightly different to what we are presenting below.

Step 1 – Sign articles of association of Polish company

The first stage of forming the limited liability company is the execution of the articles of association or signing the instrument of incorporation in case of single-shareholder limited liability company.

The articles of association or the instrument of incorporation of the limited liability company shall be prepared in a form of a notarial deed; a visit to the notary’s office is therefore necessary.

Step 2 – Deposit share capital

The second stage is making contributions to towards the share capital of Polish limited liability company (or a potential surplus above the nominal value of shares if stipulated in the articles of association).

A contribution most commonly involve depositing an appropriate sum of money into the company’s bank account. However depending on the agreement of the shareholders, it may also involve transferring real property rights onto the company (for example, land on which the residential building shall be constructed) or a movable property (for example a delivery vehicle).

Step 3 – Appoint a Management Board

The third stage of creating Polish limited liability company is the appointment of the management board. This can be accomplished in two ways:

- by way of resolution at the general shareholders’ meeting (or the decision of a single-shareholder) – this will require the general shareholders’ meeting to be convened, the minutes from the general shareholders meeting are not required to be drawn up in a form of a notarial deed, a regular written form is sufficient, or

- by way of decision of individual shareholders if the articles of association grant such a right to the individual shareholders (preferred rights).

Step 4 – File a registration application to the Company Register in Poland

The forth stage is an entry of the limited liability company into the National Court Register (KRS) – i.e. Company Register. This step is accomplished by filing an application to enter the limited liability company into the Registry Court of NCR along with all required attachments.

Step 5 – Obtain required permits in Poland

The fifth step connected with the formation of a limited liability company relates to completion of regulatory requirements and obtaining permits / licenses / concessions required to conduct specific business.

Step 6 – Open a bank account

In order to make your company fully operative you shall also open a bank account in one of the Polish banks. Theoretically, it is not mandatory for the Polish company to have a local bank account. However – practically – you will need a local Polish bank account as only such account will provide you with the following features and benefits:

- ability to make special tax and social security payments (special tax and social security payments modules)

- white listing the account in Polish Tax System – and allowing you to make payments that are considered as tax-deductible.

Key investment incentives

Low corporate tax

Standard corporate income tax rate in Poland is 19%. However, small companies (so called small taxpayers) are able to benefit from discounted 9% corporate income tax on condition that their revenues did not exceed the revenue of EUR 2 million within a tax year.

0% income tax

Companies that do not pay out the dividend and reinvest the profit do not need to pay the corporate income tax (i.e. 0% tax) if they meet certain criteria. This is so called Estonian CIT from which you may benefit if, e.g.:

- you employ more then 3 full time employees

- only natural persons are shareholder of your company

- you revenue comes predominantly from operations (and not from passive income)

- you do not prepare IAS financial statements

- you are not a lending or financial institution

- you are not operating within Special Economic Zone

- you submitted notification to competent tax office

IP Box and R&D Relief

If your company is an IP creator you may implement certain procedures (incl. IP tracking record) that would allow you to decrease you corporate income tax rate to 5%. If your company implements research and development projects you may benefit from increased tax deductible expenses (upon to 200%), which – in effect – will decrease significantly your corporate income tax.

Special Economic Zones

Special Economic Zones are separate parts of Poland (e.g. industrial parks, technology parks, investment parks) were business may be launched upon preferential terms and conditions. Benefits are agreed with the managing entity of the selected zone. Key incentives are discounts or exemptions from property tax and corporate income tax.

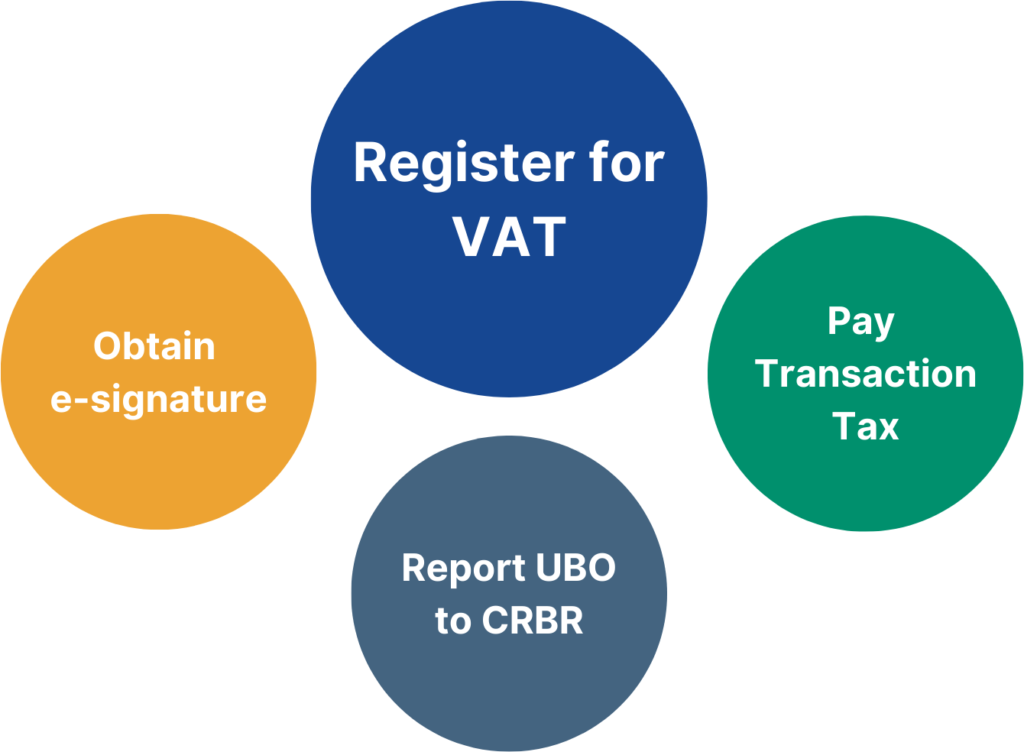

Post company registration obligations

E-signature for Management Board

Every member of the Management Board must poses an electronic signature which is eIDAS compliant. The e-signature will be used at least once a year to sign and submit the annual financial statements of the Polish company. It is important to underline that most of the world recognized e-signature provides do not offer products that are compliant with Polish law. Our agents will be able to arrange for you the e-signature at the meeting or teleconference.

UBO Reporting

As a part of AML obligations, it is mandatory to report basic data of the Ultimate Beneficial Owner of the newly incorporated company within 7 days from the moment of registration in KRS. The report shall be submitted to Polish UBO Register (CRBR).

Transaction Tax reporting & payment

Company registration in Poland triggers obligation to pay the transaction tax of 0,5% of the share capital amount. Tax return shall be submitted and the tax shall be paid within 14 days from day of execution of the articles of association.

VAT registration

Registration for VAT and EU-VAT in VIESS is not mandatory but in practice it is required to run normal business operations in Poland. VAT registration requires most usually requires 1-3 weeks and submission to the tax office of duly signed VAT-R form along with proof of company address (e.g. lease agreement).

Fiduciary company registration

- we accept instruction from the client to create a company:

- in fast track mode within 1-5 business days,

- a new, tailor made entity,

- with features as defined by the client (type, name, capital, location etc.),

- we incorporate the company on the name our Law Firm in Poland and we hold the shares in trust,

- immediately after the company is incorporated:

- we appoint directors of the company as per client instruction, and

- give away a full control over the company to the client,

- at earliest convenience we transfer the shares in the newly formed company to the persons / entities designated by the client.

Reasons

There are several reasons why our client select the service of the fiduciary incorporation service, and that is mainly because:

- foreign individuals, as well as foreign corporations, are limited in opening companies in Poland in fast track mode (due to limitations of Polish company registration system),

- registration of new company for foreign customers in standard procedure take much more time (e.g. from 3 – 6 weeks),

- level of bureaucracy and paperwork required for fiduciary company incorporation is much lower at initial stage (and the documents may be gathered and presented at later stage) .

Benefits

- availability of fast track company registration option, as a result

- ability to register the company within 1-5 business days,

- you get new, full operational company within few days,

- you get brand new company, without risks and history,

- you are able to register company with absolutely minimum bureaucracy.

Is it safe?

What is the difference between shelf company and fiduciary incorporation?

Why DKP incorporation services?

There are number of reasons why you should choose our Law Firm for your incorporation services provider:

- we have 30 years of experience in providing incorporation services on Polish market,

- we are local experts, and not foreign registration provider without presence in Poland,

- we are a Law Firm (not company registration agency), our lawyers are qualified attorneys and barristers listed with Bar and Attorneys Associations,

- we are one stop shop, i.e. we provide legal services as Law Firm, and affiliated company DPG provides Tax, Payroll and Accounting Services.

- we are distinguished with number of awards for corporate services and appreciated by worldwide recognized clients who trusted in us.

Online company incorporation

Your new Polish company can be incorporated online! We need few days make it ready and operational. What you need to do – is just fill in the online company incorporation form. Some years ago developments of Polish Law enabled us to start offering online company incorporation services. Despite of deficiencies of Polish governmental system, we have developed unique procedures that allows us to offer online incorporation services to any foreign investors regardless of their residence and nationality. How does it work? You fill in the online company registration form. Once approved, our incorporation attorneys will provide you with our offer and afterwards guide your through next stages, in order make your company ready in few working days. Everything will be completed online, no need to visit Poland !

Company formation, incorporation and registration

Above listed terms: company formation, incorporation and registration looks similar. In everyday language they are all associated with one event – i.e. company establishment. In legal terminology they have slightly different meanings:

- company formation is informal term describing entire process of company establishment,

- company incorporation is associated with execution of the Articles of Association or the Statute – which in practice creates existence of the company,

- company registration is associated with the process of registration in KRS (Company House).

Contact our company incorporation lawyers

Company registration inquiries enquiries shall be addressed to: [email protected], we will do our best to answer to you e-mail within 24 hours.

FAQ – company registration in Poland

Can foreigner register company in Poland?

Yes, there are no restrictions as to registration limited liability companies in Poland.

How much time I need to register company in Poland?

You have two options of registration – online that would take 1-5 days, and regular with notary involved that would take 2-8 weeks.

What are the company registration fees in Poland?

Official registration fee is 600 zł. However you may also need to incur some additional expenses, in particular for sworn translations and lawyers consultancy.

What is KRS number?

KRS number is number that every Polish company obtains in the process of registration. It is individual company registration number.

What is KRS register?

KRS register is company register of Poland where all the companies are listed. The register is available online and its data may be reviewed free of charge.

What is NIP number?

NIP number is simply a tax number in Poland. The tax number is also equal to VAT number.

What are corporate taxes in Poland?

Your Polish company will need to pay 9 % of corporate income tax for the revenues up to 2 mln EUR, and above 19 %. You may also benefit from 0 % of “Estonian CIT” for profit retention.

Do I need to reserve a name for company registration in Poland?

No, in Poland there is no option of name reservation. You select in the Articles of Association and register it in KRS.

Can I register single shareholder company in Poland?

Yes, you may, however there is a restriction that single shareholder company cannot incorporate another single shareholder company in Poland.

Can a foreigner be a Director in Polish Company?

Yes, nationality or residence is irrelevant here. Any mature person may act as a Director in Polish company on condition that s/he has a clean criminal record.

Can I register the company in Poland remotely without visiting Poland?

Yes, you will just need to grant a power of attorney to an attorney, who will register the company for you.

What is the most popular legal form of company in Poland?

It is definitely LLC – limited liability company – in Polish sp. z o.o. Over 94 % of newly registered companies are LLCs.

What is the minimum share capital in Polish Limited Liability Company?

It is 5.000 PLN and it shall be covered prior to registration (in regular mode registration) or within 7 days from the moment of registration in KRS (in case of online incorporation).

What is the Polish name of limited liability company?

In Poland we call it “spółka z ograniczoną odpowiedzialnością” and we abbreviate it to sp. z o.o.

Can I get a visa through company registration in Poland?

Company registration is just one of the conditions that will need to be met. You will have to prepare realistic business plan for your company and meet some additional conditions.

Do I need accounting services for my company in Poland?

Theoretically – no, but practically – definitely yes. There are lots of ongoing reporting obligations that need to be met every month. You will not be able to meet them yourself without having proper qualifications.