Last updated: 20.08.2025

In the practice of inheritance law, it is increasingly common to encounter situations in which a testator who is a foreign citizen or a foreign resident leaves a will or trust, and some or all of the beneficiaries reside in Poland.

Although the inheritance procedure is carried out in accordance with the laws of the deceased’s country, the distribution of foreign assets to Poland requires the fulfillment of certain formalities under domestic law.

Inheritance management and the international legal context

In most cases, when a will or trust is executed outside Poland, the process is administered by the local estate administrator, trustee or other authorized executor. These individuals are responsible for executing the deceased’s will and properly transferring the assets to the designated beneficiaries – including those who live abroad, including in Poland.

For individuals residing in Poland who receive cash, foreign real estate, securities or other financial assets as part of a foreign inheritance, it is crucial to understand that the acquisition of an inheritance is taxable in Poland.

Obligations of beneficiaries living in Poland

According to Polish law, people living on Polish territory are obliged to report the acquisition of property by inheritance – even if the whole process takes place abroad.

This applies both to inheritances based on a will and those resulting from the operation of foreign trust-type structures. The obligation to report applies in particular to beneficiaries who receive cash or other assets transferred from abroad.

Failure to do so can result in tax sanctions, which is why, in practice, many people use legal or tax advisors to carry out this process properly handled when they receive assets from abroad. This also helps to ensure compliance with tax obligations in Poland, as the value of inherited assets is determined for tax purposes on the date of the deceased person’s death.

In practice, it happens that all inheritance estate tax liabilities – including potential tax liabilities in Poland – are paid directly from the inheritance funds before they are disbursed to the beneficiaries. Such a practice may be in line with the local regulations of the country where the inheritance procedure is conducted, but it does not always preclude tax liability in Poland.

Therefore, before settling and distributing the foreign estate, it is worth verifying whether the taxes due have been taken into account, or whether the beneficiaries should complete the tax formalities themselves in Poland. This is an important element of advanced planning that can prevent later misunderstandings or financial liability on the part of those receiving the inheritance.

Verification of identity and data when transferring money to Poland – practical issues

When the subject of the inheritance is money transferred to beneficiaries living in Poland, the administrators of the inheritance must also take into account the requirements for proof of identity and verification of the recipients’ bank details.

In practice, this means necessity:

- confirmation of the beneficiary’s identity (e.g., through verification of an identity document), the need for certified translations,

- obtain up-to-date contact and address information of the recipient,

- verification of the bank account to which the funds are to be transferred,

- as well as often – the completion of additional documents enabling the disbursement of funds or concerning tax or legal issues.

For this reason, the complete preparation of data and documents at an early stage of the proceedings is crucial for the smooth and safe execution of the distribution of the inheritance in Poland. For foreign administrators and administrators of estates, it is particularly important to take into account domestic procedures and practices, because only then is it possible to effectively and legally transfer the estate to beneficiaries living in Poland.

Inheritance and gift tax – is property acquired abroad subject to tax?

The acquisition of an inheritance comprising property abroad may be subject to taxation in Poland if, at the time of inheritance, the beneficiary was a Polish citizen or had their permanent residence in Poland.

Polish tax regulations require that such foreign assets be valued at their market value at the time the tax liability arises, even if they are ultimately sold many years later.

These provisions are designed not to restrict the free movement of capital within the European Union.

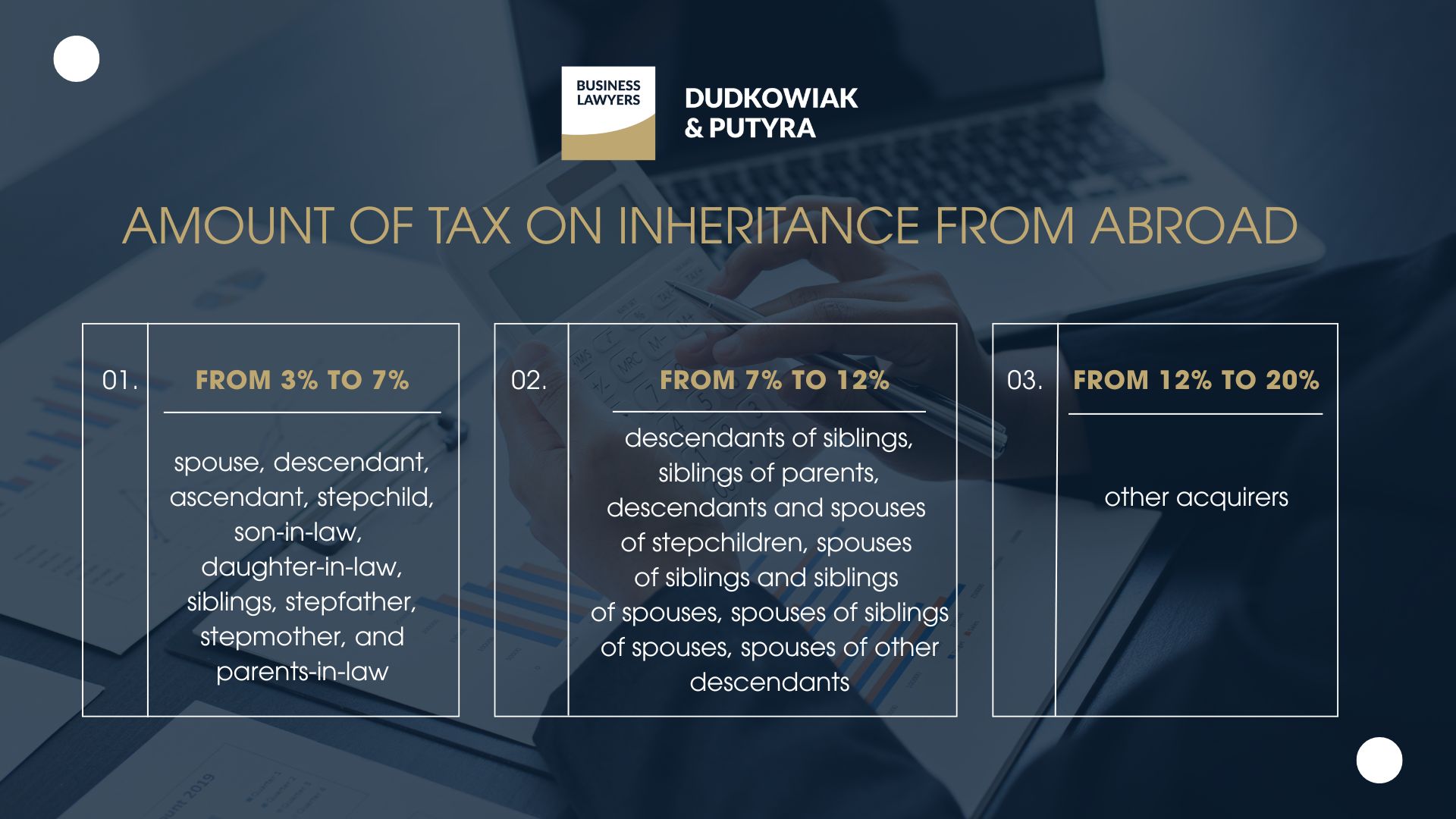

Amount of tax on inheritance from abroad – tax groups and rates

The amount of tax depends on the tax group to which the heir belongs:

- Group I (family member such as: spouse, descendant, ascendant, stepchild, son-in-law, daughter-in-law, siblings, stepfather, stepmother, and parents-in-law): from 3% to 7%

- Group II (descendants of siblings, siblings of parents, descendants and spouses of stepchildren, spouses of siblings and siblings of spouses, spouses of siblings of spouses, spouses of other descendants): from 7% to 12%

- Group III (other acquirers): from 12% to 20%

The tax must be paid within 14 days of receiving the tax authority’s decision.

If the value of inherited assets exceeds the tax‑free amount (PLN 9,637 / 7,276 / 4,902 depending on the group), the heir must submit a tax declaration (SD‑3) within one month of receiving a court decision, a notarial deed, or a European Certificate of Succession.

Double taxation of inheritance – how to avoid problems?

One of the common problems with foreign inheritances is double taxation, when the same property is taxed both in the country where it is located and in Poland. In most countries, similar rules apply, but the details depend on bilateral tax treaties.

To avoid problems with inheritance tax, you should first check whether Poland has concluded a double taxation agreement with the country in question.

In such a case, it is possible to apply a tax exemption in accordance with the taxation rules laid down in international regulations.

Inheritance from abroad – what should heirs in Poland keep in mind?

The international nature of inheritances is becoming an increasingly common phenomenon, especially in the context of the mobility of citizens and the globalization of property structures. In such cases, the distribution of an inheritance to beneficiaries living in Poland involves certain activities – both on the part of the administrator of the inheritance abroad and on the part of the beneficiaries in Poland.

Knowledge of local regulations, tax system and the practices of financial institutions is key to avoiding formal problems and tax liability. Therefore, it is worthwhile to plan the benefit payment process at an appropriate stage, verify recipients’ data and consult on tax issues – before the final distribution of assets takes place.

FAQ – Cross border inheritance in Poland

Do heirs in Poland need to report inherited foreign assets, such as foreign bank accounts or mutual funds?

Yes. Under Polish tax law, all inheritance received from abroad, including foreign bank accounts, mutual funds, shares, and other financial assets, must be reported as part of your tax reporting obligations. Failure to comply may lead to penalties and legal problems. The reporting obligation applies even if the assets are not transferred to Poland.

What documents are needed from a foreign country to start the inheritance process in Poland?

You will usually need the death certificate of the deceased person, documents confirming the circle of heirs (for example, a will, probate decision or foreign inheritance certificate) and, if necessary, certified translations of these documents into Polish.

These documents may also include evidence of funeral costs and any death benefit payments received abroad, as they can affect the final tax calculation in Poland.

Do heirs in Poland have to pay taxes directly owed on foreign assets before transferring assets to Poland?

Yes. If the inheritance includes foreign assets, heirs may first need to settle any taxes directly owed in the foreign jurisdiction, for example on foreign real estate or foreign business.

Only after these obligations are fulfilled can the process of transferring assets to Poland be finalized. Then, under Polish tax law and reporting requirements, the heir must comply with Polish rules, taking into account tax implications and possible exemptions under international treaties.

What is European Certificate of Succession?

The European Certificate of Succession (ECS) is issued by EU member states to make it easier for heirs, legatees, executors, and administrators of estates to assert their rights in other EU countries. The EPS confirms the status of heirs, legatees, executors of wills or administrators of estates and can be used in another Member State without the need to initiate separate court proceedings.

In practice, this means that the EPS can be used to prove your rights, for example, before a a foreign bank, court, authority, or other institution in another EU country. The document has a uniform format and legal effect in all member states, which significantly speeds up and simplifies inheritance proceedings involving assets in several countries at the same time.

How long does the inheritance process from abroad usually take in Poland?

The time needed to complete an inheritance case involving assets from abroad depends on several factors, such as the country where the estate is administered, the number of heirs, and whether all required documents (wills, court decisions, translations) are complete. Simple cases can take a few months, but cross-border inheritance often takes from six months to over a year, especially when court proceedings or additional formalities are involved.

Do I need a lawyer in Poland for inheritance cases involving assets from abroad?

While hiring a lawyer is not mandatory, it is highly recommended in cross‑border inheritance cases. A lawyer can help collect and translate foreign documents, represent you before Polish courts or a notary, ensure compliance with tax obligations, and avoid mistakes that may delay the process. Legal assistance is especially helpful when the estate includes property in different countries.

Cross-border inheritance – Where is the case being heard and which law applies?

In cross-border inheritance cases, it is necessary to determine the jurisdiction of the court and the applicable law. Pursuant to Article 4 of Regulation (EU) No 650/2012 of the European Parliament and of the Council, as a rule, the courts of the Member State in which the deceased had their habitual residence at the time of death have jurisdiction.

In practice, this means that a Polish court may be required to apply foreign law and that the judgment issued may be enforced in another Member State. If the case is heard in Poland, the relevant provisions of the Polish Civil Code will govern the inheritance process and property rights.