Last updated: 14.11.2024

Payment terms in Poland – key rules

In commercial transactions in Poland the entrepreneurs comply with the following payment terms rules. These rules are mostly derived from the Act on Prevention of Excessive Delays in Commercial Transactions of 8 March 2013 (i.e., Journal of Laws of 2023, item 1790).

What is the maximum payment term in Poland?

As a general rule the maximum payment term in Poland is 60 day with the reservations and exceptions presented below.

Payment terms in asymmetrical commercial transactions

Entrepreneurs operating in Poland shall not offer and agree for the payment terms longer than 60 days as this is the maximum allowed payment term in asymmetrical transactions in Poland.

If the agreed payment term is longer than 60 days, it will be substituted by operation of Polish law by the maximum 60 days payment term.

Please note that maximum 60 days payment terms also applies to payments in parts (in installments) with regards to each part.

Payment terms in symmetrical commercial transactions

Entrepreneurs operating in Poland shall not offer and agree for the payment terms longer than 60 days in symmetrical transactions unless the parties expressly choose longer payment term and the term will not be manifestly unfair for the creditor.

Even if the entrepreneur (exercising this exemption) agrees for the payment terms longer then 60 days, the entrepreneur shall never offer and agree for the payment terms longer then 120 days as that would entitle the creditor to terminate or rescind the agreement at any moment.

Interest in case of longer payment terms

Entrepreneurs operating in Poland shall not offer and agree for the payment terms longer than 30 days unless the entrepreneur accepts to pay statutory interest from the 31st day until the due date.

Payment terms not agreed contractually

Determine the payment term after lapse of 30 days if the payment term was not agreed contractually, unless the entrepreneur accepts to pay statutory interest from the 31st day;

Summary: Terms of Payment – Poland

| Transaction type |

Symmetrical transaction |

Asymmetrical transaction |

| Payment term |

|

|

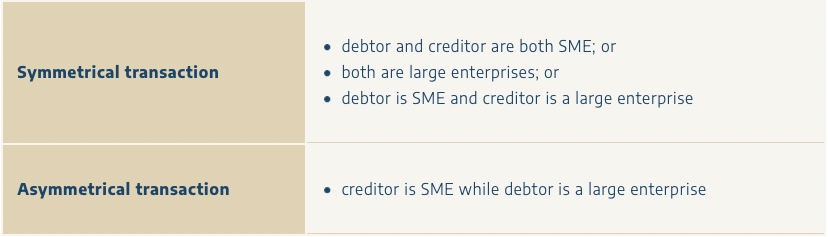

Definitions of transactions

Qualification of the entrepreneur as one of SME or large enterprise shall be done in accordance with Annex I to the Commission Regulation (EU) No 651/2014 of 17 June 2014 declaring certain categories of aid compatible with the internal market in application of Articles 107 and 108 of the Treaty.

Obligation to notify a party of its large trader status for payment purposes

If the entrepreneur would be qualified a large enterprise it will be obliged to inform the counter-party of its status at latest at the moment of conclusion of the commercial transaction.

Excessive delays in payment prohibition

An entrepreneur should never allow the sum of overdue payments and payments made late to exceed PLN 2 million for three consecutive months (PLN 5 million in 2020/21), as such delays will be considered a violation of the prohibition on excessive payment arrears.

In such situation the President of UOKiK would have a right to commence proceedings, on so-called payment congestion, which may also include dawn raids, audits and requests to provide information and documents (also from entities which are not parties to the audited transactions) and to impose fines up to EUR 50 million for non-compliance. The auditing period may cover up to 2 years in reverse, but only payments with due dates which fall after 1 January 2020 may be taken into account.

The fine for excessive delays is calculated based on specific formula [= the sum of the fines for each delay calculated in the following way: X (the overdue amount) * Y/365 (number of days overdue/365) * the penalty interest]. Repeated fines are increased by 50%.

Furthermore, information about the commencement of proceedings, as well as on the fines imposed, is published on the official UOKiK website.

Payment Terms Reporting in Poland

If the entrepreneur meets the requirements defined in art. 27b.2. Corporate Income Tax, i.e.: (1) is tax capital group, and/or (2) exceeded EUR 50 million in revenues in the previous year, it will be obliged to report annually its payment practices to the Minister of Economy (‘Report on Applicable Payment Terms’).

The reports will be made publicly available, including being published on the official website.

Reports are due by 31 January of each following year and are to be submitted through an online reporting system. Members of the management board are personally liable for reporting, and non-compliance is subject to a fine.

The payment practices report shall cover payments received and payments made in the thresholds of less than 30 days, 31 to 60 days, 61 to 120 days, and over 120 days from the invoice, delivery of goods, or performance of services, as well as payments that have been or have not been received within the terms provided for in the underlying agreements.

FAQ – Payment Terms in Poland

What is the maximum payment term in Poland?

60 days is the maximum allowed payment term by Polish legislation.

What is the deadline to report payment practices in Poland?

Payment practices shall be reported by 31 January each year for previous calendar year.