Last updated: 25.09.2025

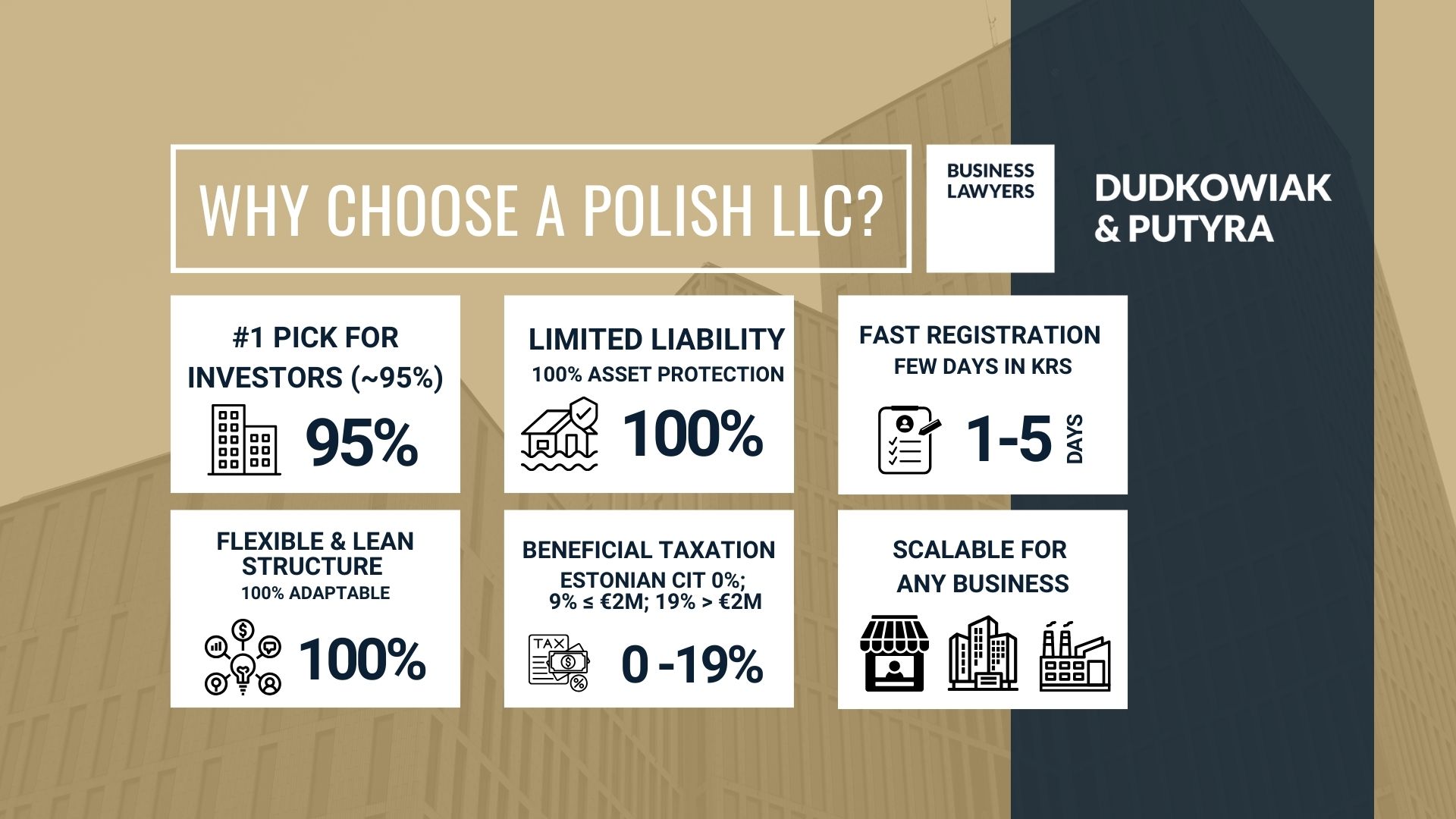

Polish Limited Liability Company (LLC) – Sp. z o.o. (spółka z ograniczona odpowiedzialnością) is the most preferred legal entity in Poland for both local and international investors. Approximately 95% of company registrations and foreign investments in Poland are carried out in the corporate form of LLC.

Although Polish Company Law provides number of alternative corporate forms – each of them brings some disadvantages (e.g. JSC – high level of bureaucracy, Partnership – no liability limitation). For this reasons investors in Poland most usually select LLCs as their Investment SPVs (Special Purpose Vehicles).

Why choose an LLC in Poland?

It is usually recommended to choose LLC in Poland, rather other corporate form as it:

- is selected by approx. ~95% of foreign investors,

- provides safety and liability limitation for shareholders; LLC helps protect personal assets, such as savings accounts, from business debts,

- provides reasonable level of bureaucracy,

- it is quick to establish and register in the Polish Company Register (KRS),

- provides beneficial corporate taxation (0 % of Estonian CIT; 9 % for revenues up 2 mln EUR and 19 % above),

- is flexible in terms of corporate changes,

- works equally well for small startups, medium ventures, and large-scale investments.

What Documents Required for LLC establishment in Poland ?

For LLC formation in Poland you will need:

- Identification Document – e.g. passport or ID – in case of individual shareholders

- Company Excerpt – e.g. good standing certificate indicating authorized signatories – in case of corporate shareholders

- Notarial POA (power of attorney) to register the LLC – to avoid visiting Poland

- Sworn translations of above documents (except for ID)

- Legalization (or Apostille) of above documents (except for ID)

Formation Timeframe for LLC

Timeline depends on the method:

- Online mode (S24): approx. 1- 5 business days

- Traditional mode (notary): approx. 1- 2 months

LLC in Poland – Key Facts

| Number of Founders | At lease 1 shareholder |

| Method of incorporation | Signing Articles of Association:

|

| Minimum share capital | 5.000 zł payable in cash or in kind contribution |

| Minimum value of each share | 50 zł |

| Taxation of LLC | 9 % of CIT for revenues up to 2 mln EUR, above 19 %, alternatively 0 % of Estonian CIT |

| Who can be a Shareholder? | No restrictions. Foreigners may be shareholders. |

| Who can be a Director? | No restrictions. Foreigners act as Directors. Directors must have clear criminal record with regards to corporate and business crimes. |

| Formation time | Online incorporation 1-5 days or

Notarial incorporation 1-2 months |

| Auditing requirement | Obligatory if 2 out of 3 conditions are met:

|

| Reporting requirement | Obligatory — once a year to KRS (National Court Register) |

| Liability of Shareholders | Shareholder hold no liability for LLC debts |

| Liability of Directors | Directors hold no liability for LLC debts on condition they timely report insolvency to the Court |

Choosing a Business Name for Your Polish LLC

When forming a limited liability company (LLC) in Poland, selecting the right business name is a foundational step in establishing your business entity.

The business name must be unique and clearly distinguishable from other registered business entities in Poland, ensuring your LLC stands out in the marketplace. Before submitting your application, it’s important to conduct a comprehensive search in the national business register to confirm that your desired business name is available and not already in use.

Polish regulations require that the business name of an entity includes the legal form, such as “Spółka z ograniczoną odpowiedzialnością” or its abbreviation “Sp. z o.o.” This not only fulfills legal requirements but also signals to clients and partners that your business benefits from limited liability protection.

Additionally, it’s wise to check for potential trademark conflicts to avoid future legal disputes and to protect your brand identity. A carefully chosen business name can enhance your entity’s credibility and help build a strong reputation from the outset, making it easier to conduct business and attract customers.

Business Licenses and Regulatory Approvals

When planning an investment in Poland, it is worth remembering that some activities are regulated. This means that, in addition to the standard LLC formation, certain sectors such as finance, energy, transport, or telecommunications may require special business licenses or concessions issued by state and local government.

These approvals are usually obtained after you form an LLC and before the business begins to conduct business. They may involve extra business filings or supporting documents, but with proper preparation and legal guidance the process is straightforward and ensures compliance with Polish state laws.

For a full list of regulated activities and licensing requirements, please see our Investor Zone – Regulatory section.

Five stages of LLC Formation

The procedure of LLC establishment in Poland consists of following stages:

- Fill in the LLC questionnaire

- Complete paperwork

- Execute Articles of Association

- Submit LLC form to KRS

- Complete reporting requirements

Details regarding each stage may be found below.

Stage 1 – Fill in the questionnaire for LLC

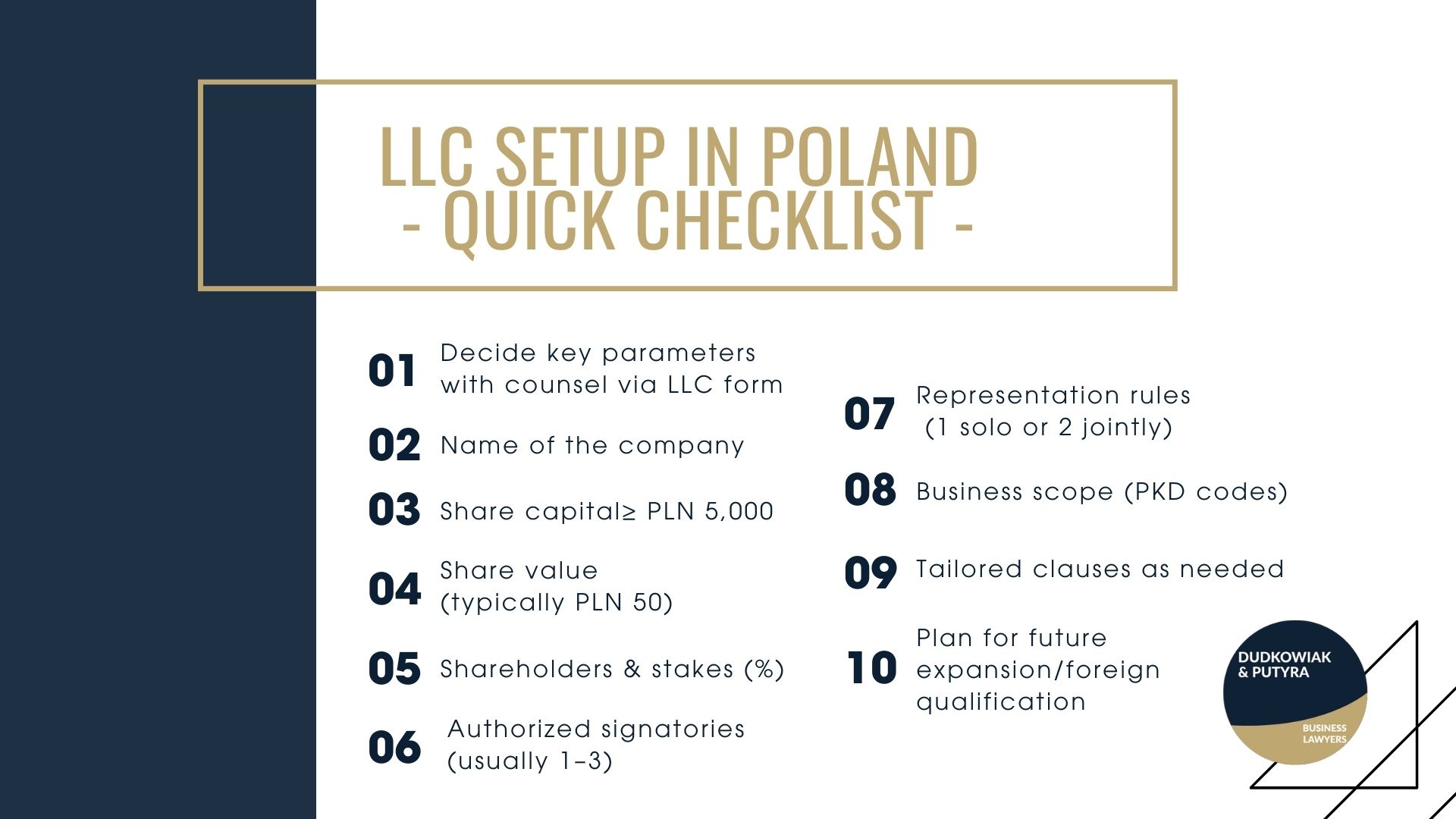

LLC formation in Poland starts with deciding on key characteristics of your future entity. This is usually done along with a specialized attorney via completing a designated LLC establishment form. This includes deciding on:

- Business Name of your future entity

- Share capital which cannot be less than PLN 5000 zł

- Value of each share, which is usually set at level of PLN 50

- Who will be the shareholder in the LLC and in which percentage

- Who will be the authorized signatory – usually 1 – 3 individuals

- What would be the rules of representation – which usually are 1 person acting along or 2 persons acting together

- LLC objectives and scope of business – which is defined in Poland by PKD codes

- Other tailored regulations desired by future shareholders

- Consider your LLC plans for future expansion, such as operating in other jurisdictions, which may require additional legal steps like foreign qualification.

Stage 2 – Complete paperwork for LLC

Completing paperwork relates to the process of documents gathering, and it is already described in above section “What documents are required to register LLC in Poland?”.

Stage 3 – Execute LLC Articles of Association

Third stage of opening limited liability entity in Poland incudes execution of articles of association. This may be done in two alternative ways:

- remotely in S24 online portal,

- traditionally with wet signatures at the office of the notary public.

Remote option is available only for natural or legal persons that are in possession of Polish Trusted Profile or eIDAS compliant e-signature. Traditional option is not restricted by any special requirements, however it is much slower and excludes the ability to establish the LLC in online – fast track.

Stage 4 – Submit LLC form to KRS

Applications to the KRS (National Court Register) must be filed electronically, regardless of whether the LLC was formed online or through a notarial deed. The submission process depends on the formation route:

- If using the S24 online system, documents are submitted directly via that platform.

- For traditionally formed entities, filings are made through the Court Registers Portal (PRS).

In both cases, key documents must be uploaded, including:

- Articles of Association.

- Appointment resolutions for directors.

- Proof of share capital contribution (for PRS route).

- Required declarations (e.g. director consents, address statements, UBO info).

Stage 5 – Complete reporting requirements

Once the LLC is ready, entered to the National Court Register, new directors are under obligation to fulfill post registration compliance that usually includes:

- reporting beneficial owner to CRBR / UBO register within 2 weeks time

- pay PPC tax (registration tax 0,5% calculated from the amount of share capital) and submit relevant tax return in this respect within 2 weeks time, unless the tax was collected by the notary public

- submit tax information form (NIP-8) to competent tax office within 3 weeks time

What are the Main Taxes that LLC Will Pay in Poland?

| CIT / Corporate Income Tax |

|

| VAT / Value Added Tax |

|

| WHT / Dividend Withholding Tax |

|

| WHT / Interest and Royalties Withholding Tax |

|

| Transfer Pricing Requirements | TP documentation, incl. benchmark (Local File) will need to be prepared for the following transactions:

|

More about Limited Liability Company in Poland

Key Features

LLC in Poland an independent legal entity with a separate legal personality from its shareholders. In practice it mean that it can buy and sell goods, as well as, hold credits and debts on its own name.

Foreign capital controlled

EU and Non-EU nationals can run and establish LLC in Poland free of any restrictions.

Minimum share capital

Minimum share capital of Polish LLC is 5.000 PLN (approx. 1.250 EUR). The share capital may be covered by monetary or non-monetary contributions (in-kind contributions, e.g. ownership of the movable or immovable property). Contribution cannot be provided in the form of services towards the organization.

Representation

Polish LLC is represented by a the Board Directors. The Board shall consist at least of one person. There is no limit as to number of Directors. Rules of representation can be freely formed in the Articles of Association of the entity. A organization may also be represented by regular proxy (pełnomocnik) or a registered proxy (prokurent).

Shareholders Meeting and Supervisory Board

Superior authority of a LLC is Shareholders Meeting. A Supervisory Board in is only compulsory when the share capital is greater than 500.000 zł and the number of shareholders is greater then 25.

Liability of shareholders and Directors of LLC

The shareholders of LLC are not liable for the entity’s obligations, they bear a risk up to the value of shares contributed.

Directors of Polish LLC may be held liable for the entity’s obligations if they fail to file for insolvency within the deadline provided by Polish Insolvency Law (i.e. within 30 days since the organization became insolvent).

Costs and Filing Fees for LLC in Poland

Setting up a limited liability company (LLC) in Poland requires covering several mandatory filing fees and compliance costs under Polish state laws. An LLC is a separate business entity, which guarantees limited liability protection and keeps personal assets apart from business debts.

Main costs include:

- State filing fees for registration in the National Court Register (KRS)

- PCC tax imposed on share capital (0.5%)

- Notarial costs if signing the articles of organization at a notary

- Annual report fees for submitting financial statements

Additional expenses may arise for:

- Preparing the LLC operating agreement and defining the management structure

- Support from a law firm or registered agent service with business filings

- Applying to local agencies to obtain business licenses

Maintaining a firm also requires a business account with a physical address, ensuring personal finances remain separate from entity operations. These clear rules make LLC registration predictable and secure for new business owners and single member LLCs.

FAQ – LLC in Poland

What identification numbers LLC has in Poland?

Every LLC in Poland has the following numbers: NIP (tax identification number), VAT, EU- VAT, REGON (statistical number) and it may also have EORI (customs) and BDO (waste register).

What are the taxes applicable to LLCs in Poland?

LLCs in Poland will mainly pay corporate income tax in default rates of 9% and 19%, unless exemptions apply.

How quickly can an LLC be formed in Poland?

Using the fast-track online process, a Polish LLC can be fully established and operational within 1 to 3 business days.

What is a Limited Liability Company (LLC) in Poland?

A Limited Liability Company (LLC / Sp. z o.o.) is the most common business structure and business entity in Poland. It is a separate legal entity that offers limited liability protection for shareholders, keeping personal assets and personal finances separate from business debts.

Why is LLC in Poland is recommended?

An LLC provides personal liability protection, tax benefits (0% Estonian CIT, 9% or 19% CIT), and a flexible management structure. Unlike a sole proprietorship or partnership, the LLC shields small business owners from direct risk.

Who can form an LLC in Poland?

Both EU and non-EU nationals, as well as foreign entities, can form an LLC in Poland. There may be only one owner (single-member LLC), or multiple shareholders. Directors can be foreigners, provided they comply with Polish LLC laws.

What legal documents are needed?

To complete LLC filing, investors must prepare:

- Passport or ID (for individual shareholders)

- Company excerpt (for corporate shareholders / foreign LLC)

- Notarial power of attorney (for remote business filings)

- Articles of Organization (Articles of Association)

- Sworn translations and Apostille/legalisation of legal documents

How long does it take to establish an LLC?

- Online incorporation: 1- 5 working days

- Notarial incorporation: 1- 2 months

This makes it one of the fastest ways for new businesses and foreign entities to conduct business in the EU.

What is the required share capital?

The minimum share capital is PLN 5,000, with each share at least PLN 50. This requirement ensures the business is a separate entity with proper corporate tax status.

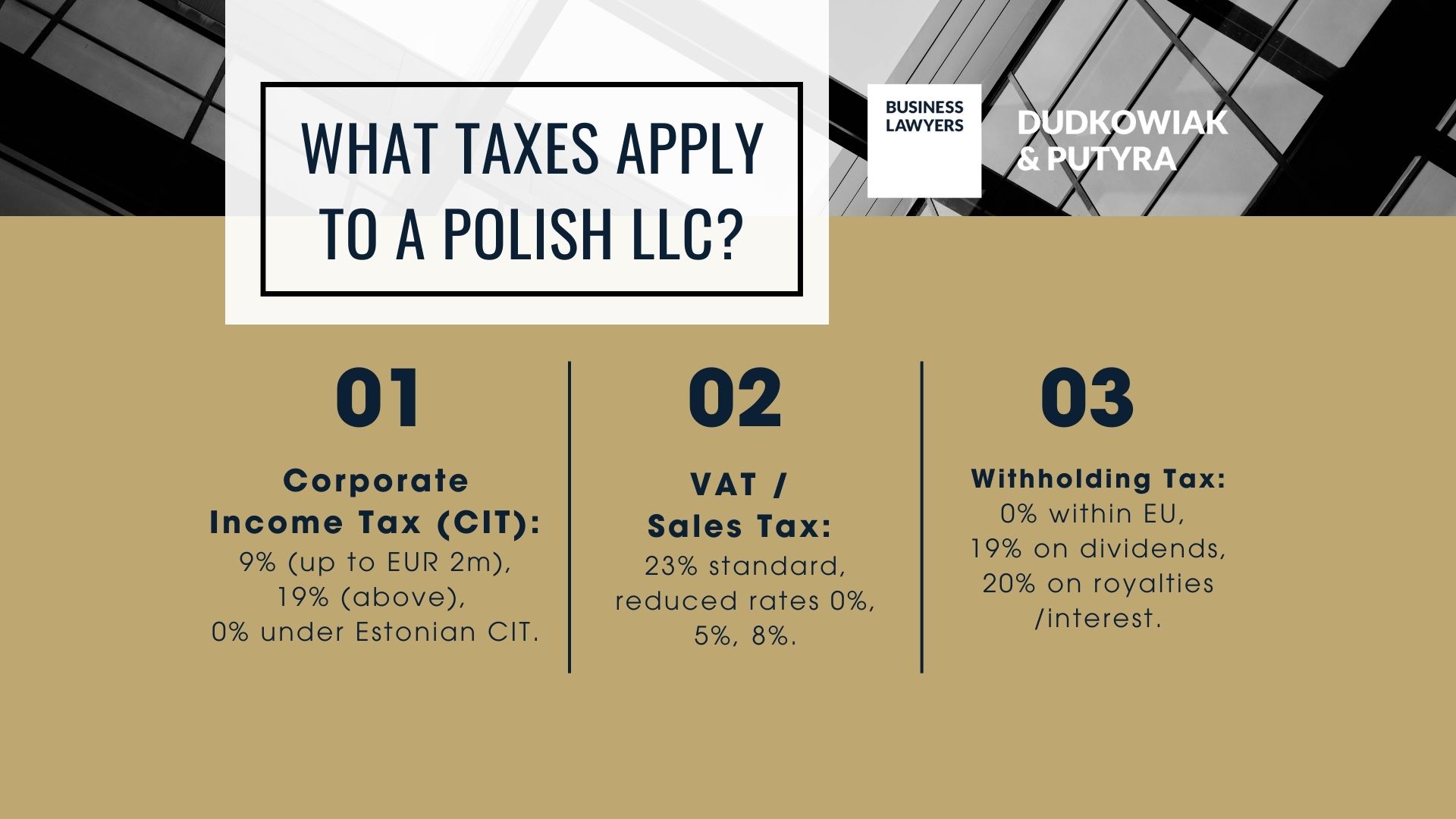

What taxes apply to a Polish LLC?

- Corporate Income Tax (CIT): 9% (up to EUR 2m), 19% (above), 0% under Estonian CIT.

- VAT / Sales Tax: 23% standard, reduced rates 0%, 5%, 8%.

- Withholding Tax: 0% within EU, 19% on dividends, 20% on royalties/interest.

What are the reporting obligations?

A Polish LLC must file an annual report with the state’s office (KRS). Shareholders have no liability beyond their contributions, provided directors meet reporting duties.

Do I need a business bank account?

Yes. A local business bank account is required for tax and compliance purposes. It separates business expenses from personal tax returns, keeps personal liability limited, and allows the entity to operate as a separate entity.

How does an LLC compare to other business entities?

Compared to a sole proprietorship, limited liability partnership (LLP), or other business entities, an LLC in Poland offers stronger personal liability protection, legal benefits, and more favorable tax status. It is the structure chosen by most businesses and many small business owners entering Poland.