VAT Registration in Poland

- Taxes in Poland

- Family Foundation in Poland

- VAT Registration in Poland

- Transfer Pricing in Poland

- Tax Exemptions for US Army Suppliers

Updated: 25.03.2024

VAT Registration in Poland – Key Facts

| Where to apply? | To your local (competent) tax office |

| How to apply? | Specific tax form (VAT-R) shall be filled in, submitted along with supporting documents. |

| Online or paper form? | Application may be submitted both in paper form as well as in online form – however only qualified electronic signature will be accepted by the Polish tax authorities |

| Supporting documents? |

|

| How long does it take? | VAT Registration usually takes from 2 weeks to 1,5 month |

| Attorneys representation? | Tax advisor representation is not required but highly recommended |

| EU-VAT | EU-VAT is separate registration required when you perform intracommunity transactions (between EU countries) |

| Is Virtual Office allowed? | No, Virtual Office will not allow you to obtain VAT registration in Poland |

| Inspection of office? | Office inspections are very common during VAT registration process |

| Do I need a bank account prior to VAT registration? | No, you do not need to have a bank account prior to VAT registration. |

| VAT Returns |

|

| VAT Returns Deadlines | VAT returns are due by the 25th day of the month following each consecutive accounting period (monthly or quarterly respectively) |

| VAT Register | Maybe found online |

When I need to register for VAT in Poland?

Registration for VAT in Poland is mandatory if you meet the definition of a VAT taxpayer and you perform operations that are subject to VAT.

Operations subject to VAT in Poland

Pursuant to the Value Added Tax Regulation, the following are subject to value added tax:

- the supply of goods and services for consideration within the territory of the country,

- export of goods,

- import of goods,

- intra-Community acquisition of goods for consideration,

- intra-Community supply of goods for consideration.

Who is a VAT payer / taxpayer?

Taxpayers are: legal persons, organisational units without legal personality and individuals who independently carry out economic activity, regardless of its purpose or result.

When to register for VAT?

VAT registration should be done before the first taxable activity is undertaken (e.g. sale of goods, provision of services, opening bank account).

Although, according to the Polish tax law, it is not necessary to formally get registered in order to be considered a VAT taxpayer, in practice, if we are not registered, we may not benefit from VAT refund or deduction. However, in a situation when you have finally formally registered for VAT and the right to refund / deduct has not yet lapsed, you shall be able to exercise this right.

Please also note that VAT registration is not a part of process of company registration in Poland. Within the incorporation procedure only NIP number is assigned to the new Polish company.

VAT-EU Registration

When a taxpayer carries out intra-community transactions (e.g. between European Union Member States), it is required to register as a VAT-UE taxpayer. Registration is carried out based on the same VAT-R registration form.

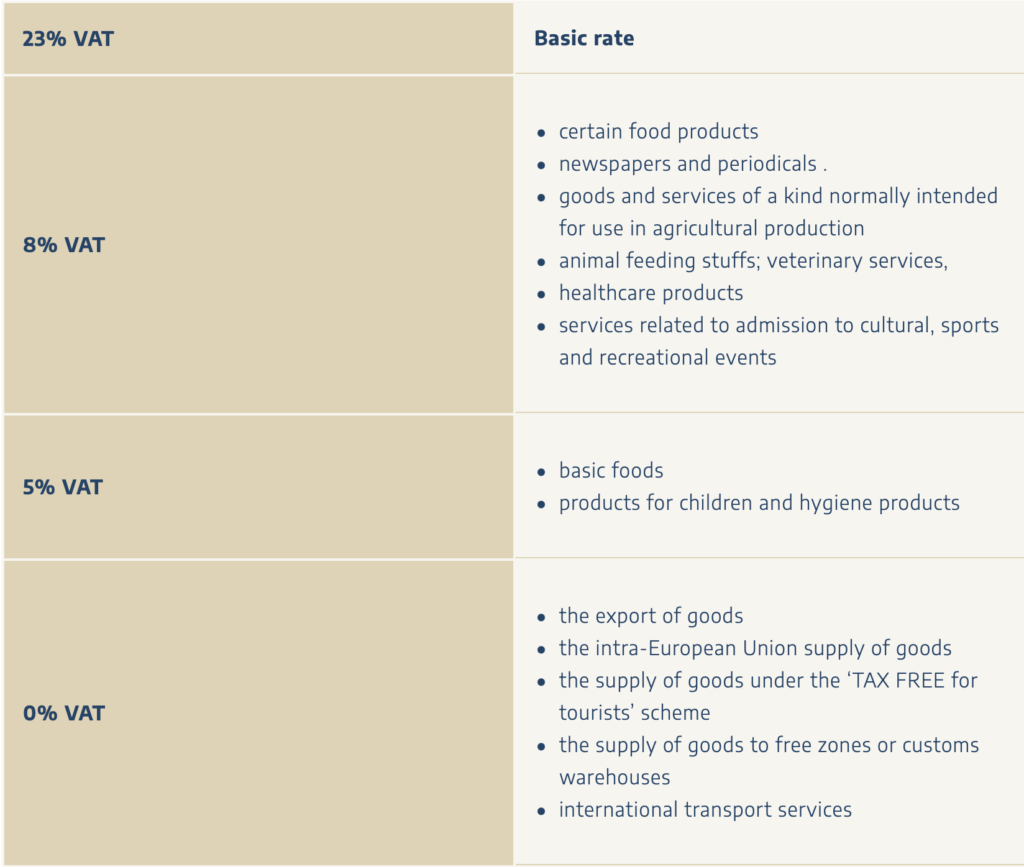

Polish VAT rates

The VAT rates in Poland are:

- Standard VAT rate – 23% (e.g. legal services),

- Reduced rate of 8% (includes construction covered by the social housing programme, services related to culture, sports, recreation)

- Reduced rate of 5% (basic foodstuffs, books, e-books)

- Preferential rate of 0% (applicable to intra-community supply of goods and export of goods).

VAT exemption versus registration

If a taxpayer benefits from an individual exemption (where sales do not exceed PLN 200 000 per annum) or a subjective exemption (performs only activities exempt from taxation pursuant to Article 43(1) of the Polish VAT Act, regardless of the value of sales), he may still register for VAT. It is also possible to resign from the VAT individual exemption. This is important in the case of commencement of business activities, when the taxpayer does not yet know whether he will exceed the sales value limit of PLN 200 000 in a given calendar year. He may registers as an exempt VAT taxpayer and so appears in the VAT register.

If an exempt taxpayer now lost the right to the exemption, he should submit a VAT registration form before the day on which he loses the right to the (individual) exemption or before the day on which he carries out the first taxable activity (when he previously only carried out activities that were subjectively exempt from VAT).

VAT Deduction

VAT can be deducted if the following conditions are met:

- The entity is a registered active VAT payer,

- The goods or services on which the taxpayer wishes to deduct VAT relate to taxable activities,

- The taxpayer has a document entitling him to deduct VAT (e.g. an invoice),

- The expenditure does not concern goods for which the legislation limits the deductibility of VAT (e.g. for expenses related to the operation of a company car used for private purposes, only 50% of VAT can be deducted).

The deduction works as deduction of input VAT against output VAT. Input VAT is VAT which is included in the price when you purchase goods or services. Out put VAT is the VAT that is included in your invoices when you sell goods or services.

As previously indicated, before the first taxable activity, the taxpayer should register for VAT (this is one of the conditions for its deduction).

How to register for VAT in Poland?

To register for VAT in Poland the application “VAT-R” must be submitted to the tax office with jurisdiction over the taxpayer’s registered office (in the case of companies) or place of residence (in the case of sole proprietorships). The largest taxpayers are subject to specialised tax offices with provincial coverage.

What Documents are required for VAT registration?

- In order to register for VAT purposes, the taxpayer must have a Polish Tax Identification Number (NIP). In the case of foreign companies, tits obtained by submitting the NIP-2 form, and in the case of individuals, the NIP-7 form. The application must be accompanied by an extract from the commercial register relevant to the taxpayer’s registered office and the articles of association. All documents in foreign languages should be translated by a sworn translator.

- The taxpayer shall make the registration declaration on the VAT-R form, choosing one of the two options: active or exempt taxpayer. The application should be submitted in person, by post or electronically. It is possible to submit the NIP-2 / NIP-7 and VAT-R forms at the same time.

- In the case of taxpayers with their registered office in the territory of the Republic of Poland, the legal title to the premises (lease or ownership) where the business activity is carried out (according to the register or records) must also be attached to the registration form.

VAT registration and bank account

It is not required to have a bank account in Poland for VAT registration. However, this is recommended in view of future VAT refunds (it is not possible to obtain a VAT refund to a foreign bank account or through an intermediary having a bank account in a Polish bank) and making payments through the split-payment mechanism (in this case, a bank account in Poland will be required).

Retroactive VAT registration

In practice, in some cases, the tax authorities register with retroactive effect, allowing VAT to be deducted on activities carried out before registration.

VAT deregistration or cancellation in Poland

Confirmation of VAT registration

It is possible to obtain official confirmation of VAT registration (which, however, involves an additional fee). However, the VAT registration status can be checked free of charge on the so-called VAT ‘white list’.

VAT Returns and Reporting

Registered VAT payers are required to submit monthly (JPK_V7M) or quarterly (JPK_V7K) VAT returns.

The first declaration must be submitted for the period in which the first taxable activity was performed (it is possible to obtain a VAT refund for the period in which the taxpayer was not yet registered). Declarations are submitted electronically by the 25th day of the month following each consecutive accounting period (monthly basis or quarterly basis – respectively). Taxpayers registered for VAT-UE are also required to submit VAT-UE declarations (by the 25th day of the month following the month in which the tax obligation arose – quarterly declarations are not possible here).

VAT Refund in Poland

- The basic deadline for VAT return is 60 days after the submission of the VAT declaration,

- The extended deadline (180 days) applies if the taxpayer has not reported any sales, including untaxed sales (purchases only), during the accounting period,

- It is also possible to reimburse VAT within a shortened period of time after fulfilling the statutory conditions (among others, the amount of VAT to be reimbursed must not exceed PLN 3 000).

VAT Registration – FAQ

How long does it take to register?

If the data indicated in the VAT-R application does not raise any doubts, the office will register the taxpayer immediately. If necessary, the office will call on the taxpayer to supplement additional documents. As a rule, the registration process should take no longer than 30 days.

What is the deadline for VAT returns?

VAT declarations shall be submitted electronically by the 25th day of the month following each consecutive accounting period (monthly or quarterly respectively)

What are the stages of VAT registration in Poland?

1. Gathering required documents

2. Submitting VAT-R form

3. Potential tax inspection / site visit

4. Registration in VAT register

5. Launch of VAT reporting (monthly or quarterly)

Where can I check if a Polish company is registered VAT taxpayer?

You can check if a company is active VAT taxpayer in online register: https://www.podatki.gov.pl/wykaz-podatnikow-vat-wyszukiwarka

What is the VAT rate in Poland?

Default VAT tax rate is 23%