Due Diligence in Poland

- M&A in Poland

- NDA agreements in Poland

- Merger control in Poland

- Due Diligence

- Taxation of share (stock) transactions

- Share Purchase in Poland

- Share Sale in Poland

Updated: 06.03.2024

Due diligence in Poland – Key Facts

| Due diligence – definition | Essential part of the transaction, which provides the comprehensive information on the legal status and potential risks related to the target entity and its assets, which may be a subject to the acquisition in Poland. |

| Aims of due diligence |

|

| Usual types of due diligence |

|

| Who may order due diligence |

|

| Time required for due diligence |

|

| Source documents | Due diligence is usually run based on:

|

What is legal due diligence for?

Due diligence is an essential part of the transaction, which provides the comprehensive information on the legal status and potential risks related to the target entity and its assets, which may be a subject to the acquisition in Poland. Due diligence may consist of different audits, e.g., legal, financial, tax, operational, commercial or environmental.

Due Diligence in Polish Law

Due diligence is no separately regulated by Polish Law. The process and related principles entirely source from international practice of M&A transactions.

As everywhere else in the world, due diligence in Poland is an essential part of the transaction. It provides the comprehensive information on the legal situation and legal risks related to the target entity and its assets, which may be a subject to the acquisition process.

Failure to check certain legal aspects may result in the failure of the investment or a significant increase in its cost.

Scope of legal due diligence

Scope of the legal due diligence is usually tailored to particular circumstances, e.g., objectives and size of the transaction, transaction timeline, availability of materials, selection of risk sensitive areas.

Usually, comprehensive pre-transaction buyer legal due diligence investigation covers the following fields:

Other types of due diligence

Aside from legal due diligence typically parallel additional types of due diligence investigations are performed in order to examine relevant risk sensitive areas, e.g., tax due diligence, financial due diligence, environmental due diligence, IT due diligence, IP due diligence.

Due diligence procurement

The legal due diligence is often conducted at the request of the potential buyer (buyer due diligence), who is interested in gathering the key information on the legal status of the target company in Poland or its property.

Obtaining detailed knowledge of all important legal aspects allows you to make a responsible and informed decision on participating in the investment and get prepared for the negotiations.

Sometime, due diligence investigation is requested by the vendor (vendor due diligence). Such legal investigation is carried out at the request of the seller (vendor) before initiating negotiations with potential investors.

Vendor due diligence analysis allows you to prepare the Polish company or its assets for valuation and sale. In particular, by resolving specific legal issues and minimizing or eliminating legal risks that could be used in negotiation process by the potential buyers.

Procurement of due diligence usually consists of conflict check, conclusion of letter of engagement and signing / obtaining power of attorneys / authorizations.

Due Diligence report

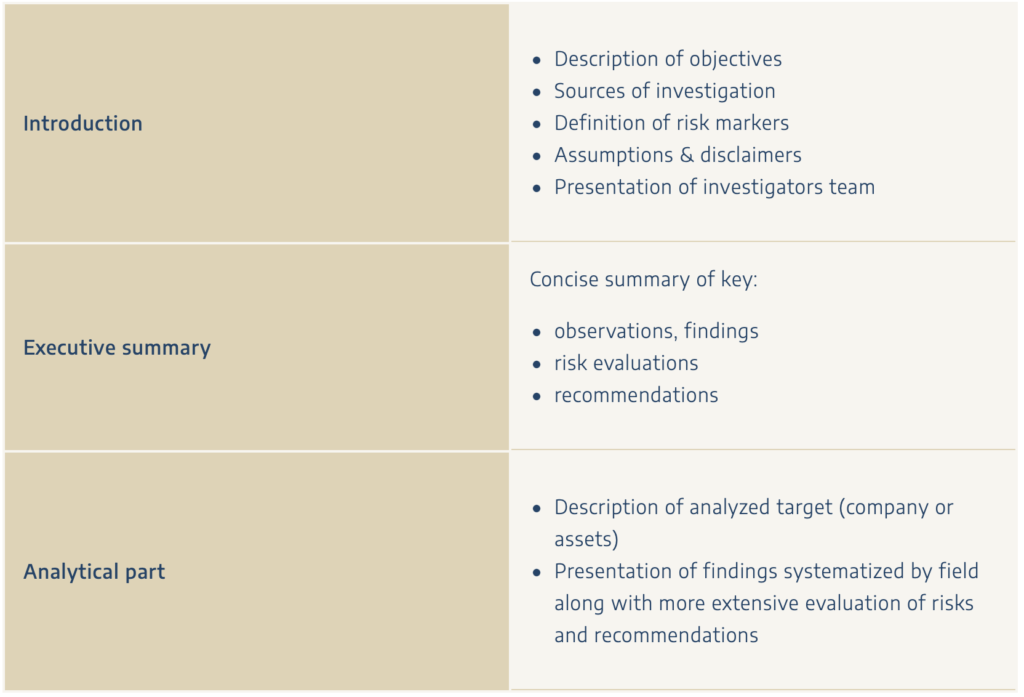

A classical due diligence report consists of three key parts: introduction, executive summary and analytical / description part.

Tax due diligence

Tax due diligence usually covers verification of tax risks and the following tax aspects by specialized tax advisors:

- Tax arrears verification

- Corporate Income Tax (CIT)

- Capital gain tax (CGT)

- Withholding tax (WHT)

- Value Added Tax (VAT)

- Transfer Pricing (TP) compliance

- Transfer Tax (PCC)

- Real Estate Tax (RET)

Most usually tax risks due diligence concentrates of two key taxes, i.e., CIT and VAT, which includes verification of:

- CIT returns

- CIT calculations

- classification of expenses and revenues

- correctness of the tax-deductible expenses

- VAT returns and VAT refunds

- applicable VAT rates verification

- correctness of the tax point

- input VAT

- international transactions on goods and services

Due diligence – details of investigation

Corporate

- shareholders’ structure

- title to shares

- restrictions in share disposals

- pledge, usufruct and other shares encumbrances

- verification of the Articles of Association

- verification of Shareholders’ Agreements

- verification of internal regulations

- shares and bonds emissions

- capital and personal relations with other entities

- surcharges, additional payments

- verification of National Court Register

- verification of UBO register

- verification of reporting obligations

- analysis of Financial Repository

- analysis of corporate governance

- verification of POAs and authorizations

- corporate disputes

Real estates / real property

- ownership title (legal title)

- mortgages and easements

- perpetual usufruct rights

- usufruct and other encumbrances

- development conditions

- local zoning plans

- conservation requirements

- construction process

- reprivatisation claims

- management and maintenance

- property services and utilities

Here you may find more about: real estate due diligence.

Key movables / fixed assets

- vendor’s legal title

- lease agreements

- pledges, usufruct

- other encumbrances

Agreements / Commercial

- change of control clauses

- key commercial contracts

- insurance agreements

Competition law

- non-competition agreements

- exclusivity clauses

- consortium agreements

- market sharing agreements

Antitrust law

- examination of common markets

- merger control / clearance

Litigation

- pre-court disputes and claims

- court and administrative proceedings

- arbitration and mediation

Regulatory

- review of regulatory requirements

- permits, concessions, and licenses

- investment control FDI clearance check

Financial matters

- review of financial documents

- credit facilities

- key loans

- sureties

- grants and subsidies

- guarantees and warranties

- contracts with financial institutions

Employment

- employment structure

- internal employment law regulation

- HR policies

- employment and B2B contracts

- material liability agreements

- non-competition agreements

- non-solicitation agreements

- collective labour agreements

- trade unions

- collective labor law regulations

- labour law disputes

- employment termination disputes

Environmental

- review of environmental decisions

- environmental clearance

- environmental regulations, restrictions

- environmental standards and policies

- environmental fees

Data protection

- GDPR implementation status,

- subject and scope of personal data processing

- contracts for entrusting of personal data

- personal data protection inspector

- data protection complaints and proceedings

Intellectual property rights

- verification of title to copyright and IP

- IP transfers and license agreements

- software licenses

- patents, trademarks

- industrial signs and utility models

- confidential information, NDA

- know-how and trade secrets

- copyright disputes and claims

- proceedings before Polish Patent Office

Public aid

- state grants and subsidies

- EU grants and subsidies

- tax exemptions

- exemption from social security contributions

- co-financing from PFR

- disputes and proceedings related to state aid

FAQ – Legal Due Diligence

What is the timeline for legal due diligence in Poland?

The duration and scope of the due diligence process in Poland depend on the size of the acquired company or asset and the transaction timeline.

This diligence process can take from a few days to several months, depending on the complexity of the business transactions involved.

Who may perform legal due diligence?

Legal due diligence services can only be performed by licensed professionals such as attorneys and barristers, as well as authorized law firms. Conducting due diligence requires specific expertise to ensure compliance with legal standards and to mitigate risks.

What are the risk markers in due diligence investigations?

Risks in due diligence investigations are usually evaluated on a scale of high, medium, and low. High risks are non-removable and highly probable, whereas low risks are typically removable and may not necessarily materialize. Proper risk management and assessment are crucial in this process.

What does a classic due diligence report include?

A classic due diligence report has three main parts:

- Introduction: Outlines objectives, investigation sources, risk markers, assumptions, and the investigators team.

- Executive Summary: Summarizes key observations, findings, risk evaluations, and recommendations. It helps assess risks involved and supports sound decision-making for the acquiring firm.

- Analytical Part: Provides detailed analysis of the target (company or assets) with extensive evaluation of risks and recommendations. It focuses on the due diligence checklist, potential risks, business relationships, property inspections, sales contracts, and material facts. It covers own due diligence, contingent due diligence, and examines the value chain and business arrangement.

Why should you consider due diligence?

Due diligence is crucial in any business transaction. It provides comprehensive information on the legal status and potential risks of the target entity and its assets. By conducting due diligence, you can:

- Identify legal risks and areas for further investigation.

- Understand the business structure and operations.

- Perform valuations and make informed recommendations.

- Mitigate risks and ensure legal compliance.

- Make informed decisions that protect your investment.

- Conduct enhanced due diligence for thorough risk assessment.

- Manage due diligence costs and requisite effort efficiently.

- Ensure compliance with public offerings and regulations, considering human rights and individual investors.

Understanding the full scope and meaning of due diligence helps ensure thorough investigation and strategic investment decisions.

Due Diligence in Poland – Legal Services

Are you seeking an experienced law firm for due diligence in Poland? Explore our case studies and awards to see how we handle various forms of due diligence, including financial due diligence, business due diligence, and property inspections.

Contact our corporate and M&A attorneys for tailored offers that fit your business arrangements and compliance procedures. We provide transaction advisory services throughout Poland, including in Warsaw, Kraków, Poznań, and Wrocław.

Our team focuses on delivering sound decisions through informed decisions, assessing potential risks, and ensuring all requisite efforts are made for thorough diligence investigations.

Legal due diligence involves thorough diligence audits, review of financial statements, shareholder value analysis, and ensuring human resources and business relationships are properly scrutinized.

We understand the importance of conducting due diligence to evaluate material information, financial records, and the supply chain to inform decision-makers and ensure the best outcomes for your transactions.