Last updated: 24.09.2025

Crypto status in Poland

Until MiCA comes into force on December 30, 2024, the crypto legislation status in Poland remains quite simple, as it is governed mainly by the Polish Anti-Money Laundering and Terrorist Financing Law.

Currently, those entities who wish to provide services related to crypto assets are required to obtain a cryptocurrency license and register in the Register of virtual currency activities. Once registered, VASP (virtual asset service provider) can provide the following services:

- exchange between virtual currencies and FIAT money (for example EUR to BTC or BTC to USD),

- exchange between virtual currencies (for example BTC to ETH),

- intermediation in exchange indicated in a – b above,

- custody services (providing crypto wallets).

The VASP registration is fast, and straightforward:

- it takes 14 days to register the company as VASP,

- there cost of the registration is PLN 616 + minor costs like power of attorney duty stamp (PLN 17 /per proxy),

- minimum paperwork is required (statements from future VASP boar members, and beneficial owners).

Benefits of obtaining virtual asset service provider license (VASP) in Poland

- Poland offers a vibrant environment for crypto investments, with tech-savvy workers, growth oriented population, and competitive registration costs. Obtaining a crypto exchange license can further enhance your ability to operate legally and attract more investors.

- The transitional period allows entities on the VASP register to continueto provide servicesas before (based on the draft Polish Cryptoassets Market Act art. 162-163):

- 4 months from the date of entry into force of the Act or

- 9 months from the date of entry into force of the draft act under the condition that VASP submit a complete application for a CASP license and receive notification of the completeness of the application from the Polish Financial Supervision Authority (in Polish Komisja Nadzoru Finansowego) within 3 months of the date of entry into force of the act.

- it opens opportunities within the growing Polish cryptocurrency market, enabling you to offer services directly to Polish consumers and businesses, including partnering up with financial institutions, and payments providers.

Crypto market in Poland for virtual asset service providers

As per Fintech Foundation report of 2023, the Polish FinTech ecosystem, though relatively young, is already well-developed and set for further growth. Poland is the biggest financial services market in CEE which will likely allow it to attract talent and investment from the entire region. Macroeconomic forecasts show space for future growth.

1. As of 30 December 2024, there are 1,841 VASPs actively registered in the register of activities related to virtual currencies. However, not all of them are actually operating.

Difference between VASP and CASP license

- Under MiCA (effective 30 December 2024), companies wishing to provide crypto-asset services will need to obtain a CASP authorisation to legally operate in the EU.

If you’d rather watch than read, check out our latest video where we explain the main differences between VASP and CASP, and how MiCA will impact the crypto sector in Poland.

A cryptocurrency exchange license is essential for those looking to start a crypto exchange, as it ensures compliance with regulatory requirements and enhances business credibility.

Entities that have not engaged in cryptocurrency activities by 30 December 2024 will have to apply for a CASP licence before commencing operations (they will not benefit from the transitional period). Current entities entered in the VASP register (register of virtual currency business activities) will be able to provide services under a VASP licence during the transition period, until 1 July 2026 (unless Polish regulations shorten this period).

CASP license will enable passporting rights, so once the applicant is approved in one member state, then your company can provide the same services across the EU without added licensing.

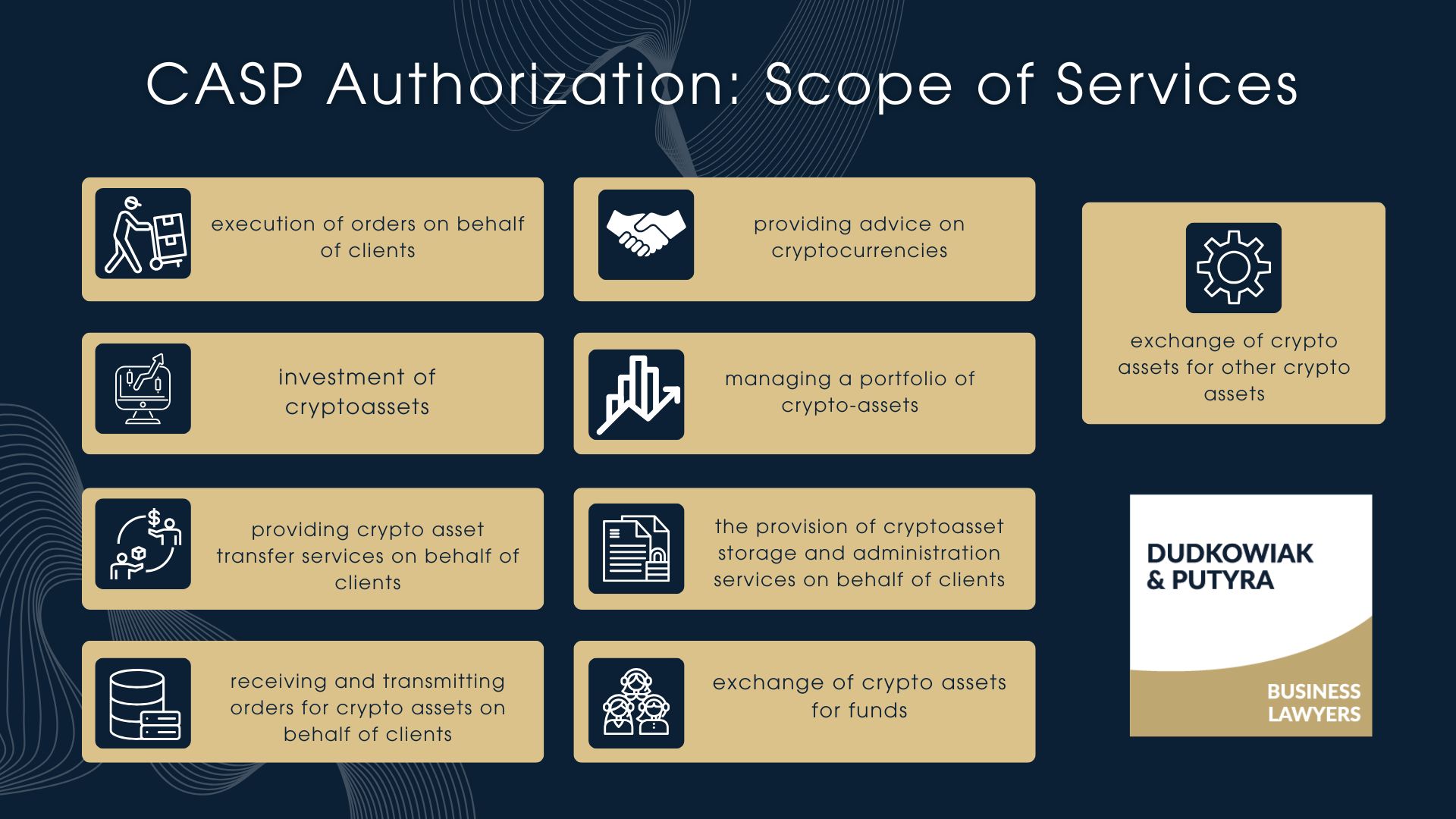

CASP Authorization will be required for the following services:

- execution of orders on behalf of clients

- investment of cryptoassets

- providing crypto asset transfer services on behalf of clients

- receiving and transmitting orders for crypto assets on behalf of clients

- providing advice on cryptocurrencies

- managing a portfolio of crypto-assets

- the provision of cryptoasset storage and administration services on behalf of clients

- exchange of crypto assets for funds

- exchange of crypto assets for other crypto assets.

Detailed information on CASP license are available under this link.

What are the crypto license requirements in Poland?

The company interested in running business activities in the scope of transactions covering virtual currency must fulfill the specific requirements for obtaining crypto trading licenses:

- no criminal record requirement,

- professional qualifications requirement.

| No criminal record requirement for individual, incl. managing persons and beneficial owners | an individual person who has not been legally convicted of an intentional crime against the activities of state institutions and local government, against the administration of justice, against the credibility of documents, against property, against economic turnover and property interests in civil law transactions, against money and securities trading, against a crime of terrorist financing and an offense committed for the purpose of material or personal gain or an intentional fiscal offense, |

| No criminal record requirement for entity | the entity, in which the shareholders (partners) entrusted with running the company’s affairs or authorized to represent the company, or members of the management bodies have not been legally convicted of a crime referred to in point 1) above or an intentional fiscal crime, |

| Professional qualifications requirement | persons performing activities in the field of virtual currencies are required to have knowledge or experience related to the activities in the field of virtual currencies, the above condition is deemed to be met in the case of:

– confirmed by relevant documents. |

Only the entities which fulfill both of the above-mentioned requirements will be entered to the register of activities in the field of virtual currencies.

Post-crypto-registration obligations under Polish law

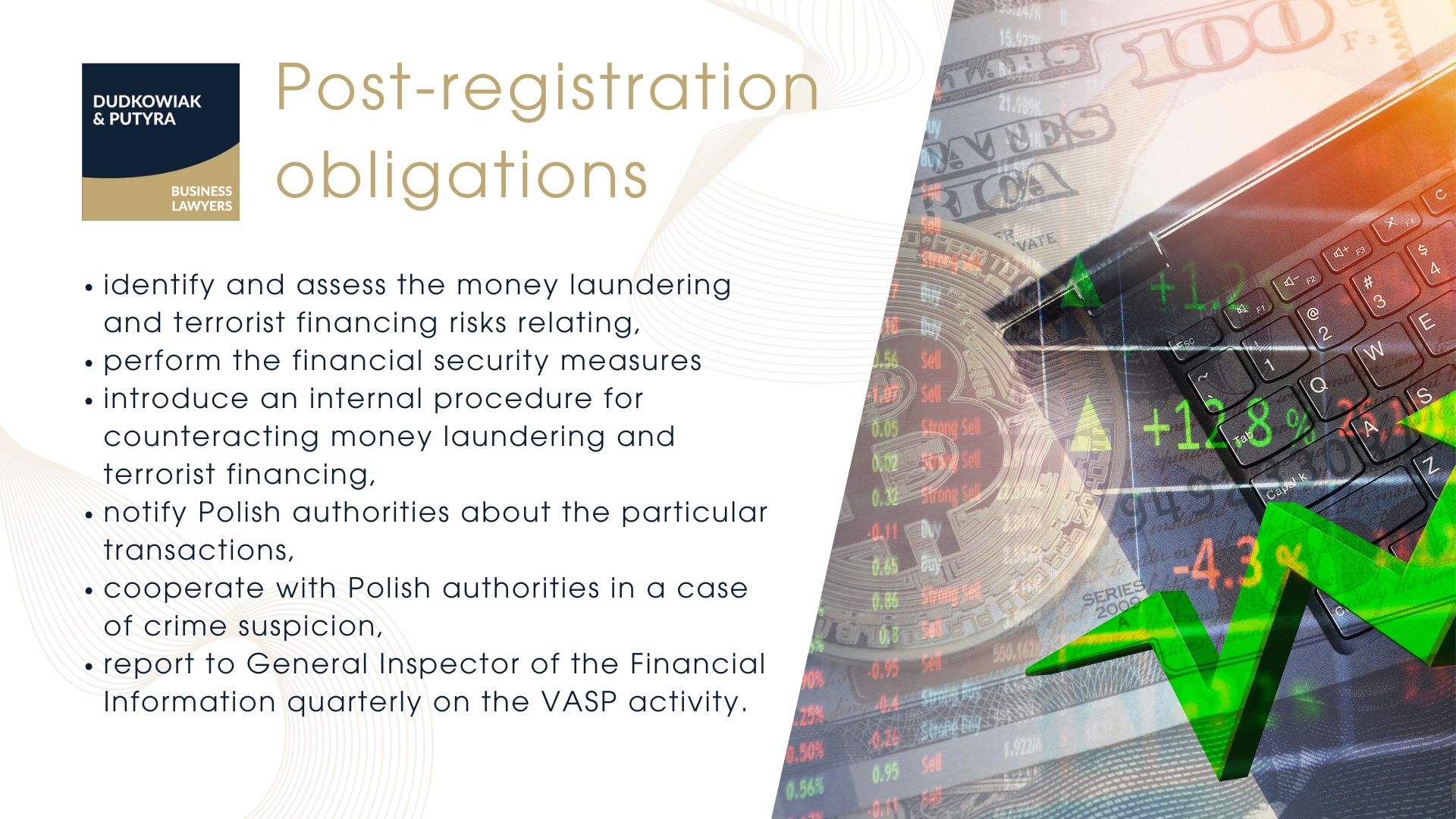

If the company conducts business activity as a virtual currency service provider, it shall perform several specific post-registration obligations established in Polish law, in particular it shall:

- identify and assess the money laundering and terrorist financing risks relating to its activities,

- perform the financial security measures especially:

- customer identification and verification of identity,

- identification of the real beneficiary and taking reasonable steps to:

- assessment of business relations and, as appropriate, obtaining information on their purpose and intended nature,

- ongoing monitoring of the customer’s business relations,

- introduce an internal procedure for counteracting money laundering and terrorist financing,

- notify Polish authorities about the particular transactions,

- cooperate with Polish authorities in a case of crime suspicion,

- report to General Inspector of the Financial Information quarterly on the VASP activity.

What are VASP reporting obligations in Poland?

Virtual asset service providers (VASP) in Poland are subject to mandatory reporting of quarterly statistical data to GIIF via a designated portal. Reports shall be submitted on a quarterly basis within 18 days of the end of the quarter.

Sanctions for violation of the crypto-business obligations under Polish law

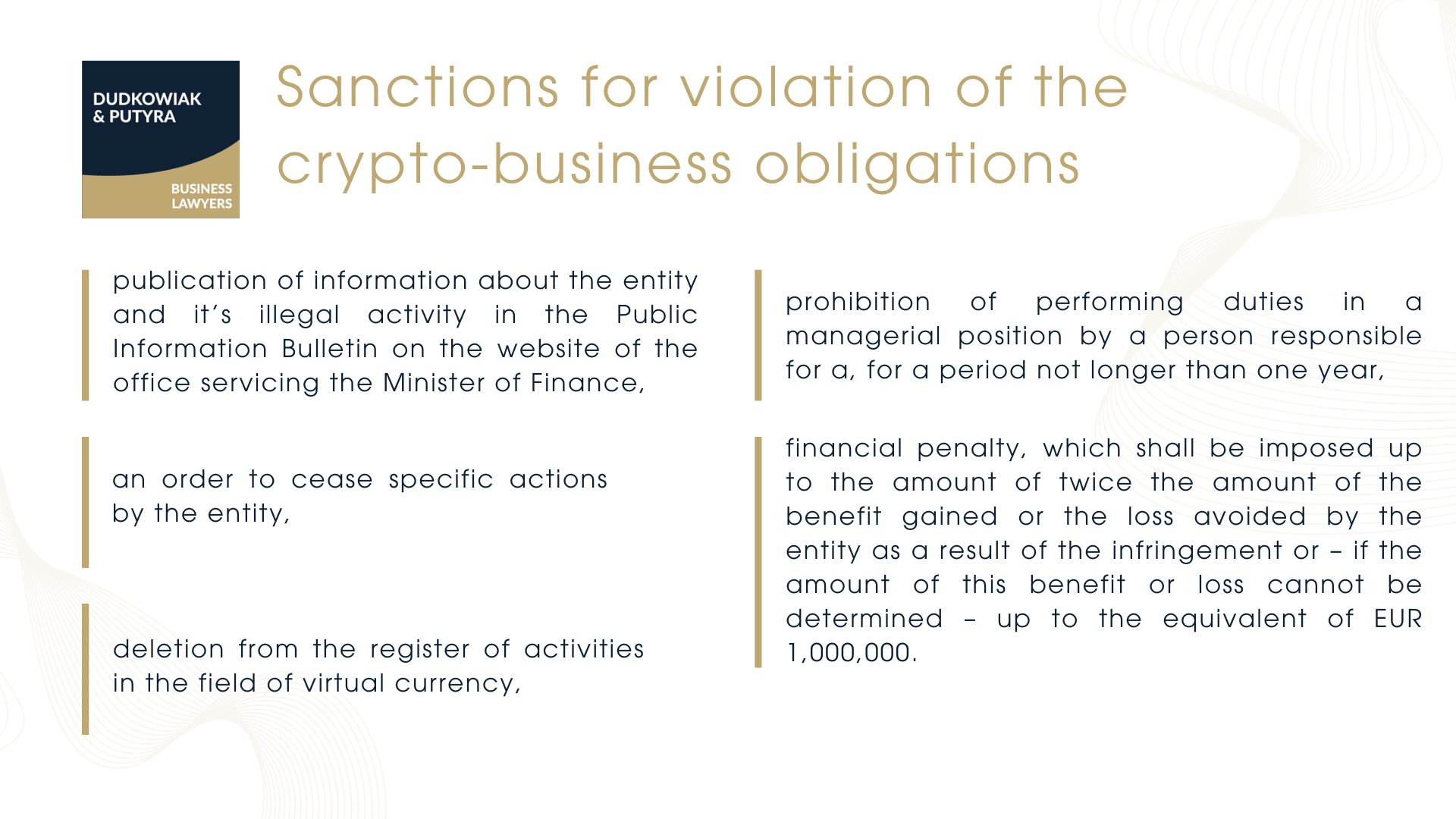

In the case of improper performance or non-performance of the post-registration crypto-business obligations, there might by imposed administrative penalties by Polish authorities, covering in particular:

- publication of information about the entity and it’s illegal activity in the Public Information Bulletin on the website of the office servicing the Minister of Finance,

- an order to cease specific actions by the entity,

- deletion from the register of activities in the field of virtual currency,

- prohibition of performing duties in a managerial position by a person responsible for a, for a period not longer than one year,

- financial penalty, which shall be imposed up to the amount of twice the amount of the benefit gained or the loss avoided by the entity as a result of the infringement or – if the amount of this benefit or loss cannot be determined – up to the equivalent of EUR 1,000,000.

In addition, a person acting for or on behalf of the entity, which fails to notify Polish authorities about crime suspicion or provides with false or conceals true data concerning transactions, accounts or persons, shall be punished by imprisonment from 3 months to 5 years.

Crypto & VASP in Poland – Q&A

Is the activity in the field of virtual assets and currencies (cryptocurrencies) legal in Poland?

Yes, as long as there is no explicit prohibition, the activity in the field of virtual currencies (cryptocurrencies) is basically legal in Poland.

Is the activity in the field of virtual currencies (cryptocurrencies) and crypto assets legal in European Union?

Yes, the activity in the field of virtual currencies (cryptocurrencies) is generally legal in European Union, which was confirmed by the Court of Justice of the European Union in the judgment of October 22, 2015 (C-264/14).

Is the cryptocurrency business supervised by Polish financial authorities?

Generally, cryptocurrency business is currently not a part of the financial market within the meaning of Polish law, so basically it is not a subject to a specific, financial supervision. The authority that maintains the registry of virtual currencies has the ability to inspect the activities of VASPs for the company’s compliance with the conditions for registration.

How long does the crypto registration process in Poland take?

The Director of the Tax Administration Chamber in Katowice, under the authorization given by Minister of Finance, makes an entry of the applicant to the register of activities in the field of virtual currencies within 14 days from the date of receipt of the properly fulfilled and filed application with required documents enclosed to it.

When my crypto license application may be refused?

There are several situation when the Polish authorities are competent to issue an administrative decision on refusal to make an entry of the entrepreneur into the register of activities in the field of virtual currencies.

In particular it may happen if: the application is incomplete and has not been completed within the prescribed period, the data contained in the application are inconsistent with the facts, or if a legally binding decision prohibiting the entrepreneur from carrying out the business activity covered by the entry has been issued.

How can I defend against the refusal of my crypto license application?

If the Polish authorities issue an administrative decision on refusal to make an entry into the register of activities in the field of virtual currencies, the applicant is entitled to request for reconsideration of the case by the Minister of Finance or to file an appeal directly to the competent Regional Administrative Court.

Are there any specific post-registration obligations related to virtual currency business in Poland?

Yes, if the entrepreneur conducts a business activity in the field of virtual currency he shall perform a several specific post-registration obligations established in Polish law, in particular it shall: identify and assess the money laundering and terrorist financing risks relating to its activities and perform the financial security measures especially.

Can I entrust the performance of post-registration obligations to a third party?

Yes, the outsourcing is acceptable, however, it can concern only the services related to the financial security measures. It should be also remembered that entrusting these services to the third parties does not absolve the entrepreneur from his liability.

Are there any sanctions for violation of the post-registration obligations under Polish law?

Yes, in the case of improper performance or non-performance of the post-registration obligations, there might be imposed administrative penalties by Polish authorities. In addition, a person acting for or on behalf of the entity, which violate some of provisions might be criminally liable.

Is PSD2 license required for crypto currency activity?

Generally, PSD2 license is not required for crypto currency activity. However, if the crypto currency activity covers the provision of payment services, PSD2 license might be needed. Specifically, in some cases it may be necessary to obtain domestic payment institution license (KIP) or small payment institution license (MIP).

What services can cryptocurrency companies provide with crypto licenses in Poland?

Cryptocurrency companies can provide cryptocurrency exchanges, crypto transactions, and custodial services for digital assets. They may also validate blockchain transactions and offer financial services related to digital currencies and other virtual assets.

What are the main requirements for the licensing process?

The licensing process requires compliance with financial regulations and regulatory obligations. Applicants must be a natural or legal person with no criminal record and meet minimum share capital requirements. A certification program or relevant experience is required for those managing cryptocurrency operations.

What are post-registration obligations for crypto businesses?

Crypto businesses must identify suspicious transactions, implement risk mitigation measures, and report to regulatory authorities. They must also comply with financial action task force standards and manage crypto transactions responsibly in the crypto space.

What does the transition period look like for entities entered in the VASP register?

What does the transition period look like for entities entered in the VASP register?

The transitional period allows entities on the VASP register to continue to provide servicesas before(based on the draft Polish Cryptoassets Market Act art. 162-163):

- 4 months from the date of entry into force of the Act or

- 9 months from the date of entry into force of the draft act under the condition that VASP submit a complete application for a CASP license and receive notification of the completeness of the application from the Polish Financial Supervision Authority (in Polish Komisja Nadzoru Finansowego) within 3 months of the date of entry into force of the act.

However, the Polish Act on cryptoasset markets is currently undergoing legislative proceedings, which means that the above dates and periods may be subject to change.

Given that the Polish law on the crypto-asset market has not yet entered into force, is it still possible to apply for entry in the VASP register?

No. According to the current statement of the General Inspector of Financial Information, no new entities may be entered in the VASP register after the entry into force of the MiCA Regulation (30.12.2024).

In this case, we suggest either acquiring a company already entered in the VASP register or preparing to submit an application for a CASP licence.

We will help your business find a solution for both paths.