New FATF Guidelines: Recommendation 16 as revised – what does this mean for the financial industry?

On June 18, 2025, the Financial Action Task Force (FATF) published the revised content of Recommendation 16.

What are the most important changes?

New title and purpose

Recommendation 16 has been given a new title: “Payment transparency” (“Payment transparency”). The purpose of the recommendation itself has also been expanded and clarified – it is no longer solely for counter-terrorism purposes, but also aims to counter money laundering and “related predicate offenses (e.g., fraud).”

The list of rationales justifying obligated entities’ taking appropriate measures when a specific risk is detected during a handled transfer (e.g., stopping a transfer) has also been expanded to include cases of identified risk of proliferation of weapons of mass destruction and their financing.

More details on the information collected and shared:

- For the first time, there is a requirement that accurate information about the sender (the “originator”) and recipient (the “beneficiary”) of a transfer (i.e., the original sender and the final beneficiary of the transfer) be “as structured as possible.”

- The Recommendation itself adds a reference to UN resolutions on preventing, suppressing and disrupting the proliferation of weapons of mass destruction and their financing.

- Attention was drawn to the proper terms the FATF currently uses for sender (“originator”) and recipient (“beneficiary”).

Expanded scope and sanction control:

- Part B “Scope” extends the applicability of the Recommendation also to domestic transfers (not only – as before – to international ones)

- It was stressed that the obligations imposed by the Recommendation may vary depending on the type of payment.

- Recommendation 16 does not apply to VASPs and CASPs – Travel Rule will be directed to these entities under Recommendation 15.

- Footnote No. 49 of the Interpretative Note adds information that Recommendation 16 does not say how sanctions list screening is to take place, and the FATF adds that this screening does not require real-time sanctions screening.

New requirements for identifying the parties to a transaction:

- Part C clearly indicates which provider the transfer chain starts with (the one receiving the instruction) and which one (crediting the account or transferring the funds to the beneficiary) it ends with. It should be possible to identify which specific financial institutions hold the originator’s and beneficiary’s accounts and in which countries these institutions are located.

- A requirement has been added for financial institutions to ensure that account numbers are not used to disguise the identification of the country in which the financial institution handling the account is located. This is intended to increase transparency by limiting relationships established, for example, in the mode of issuing virtual IBAN numbers.

- For international transfers for amounts over $1,000/EUR, always include the name of the sender and beneficiary, their account numbers (primary account), and if there is no account, the unique transaction identifier. In addition, the address of the sender (country and name of the city or “nearest alternative”) and, in the case of the beneficiary, the country and name of the city (or “nearest alternative”) must be given

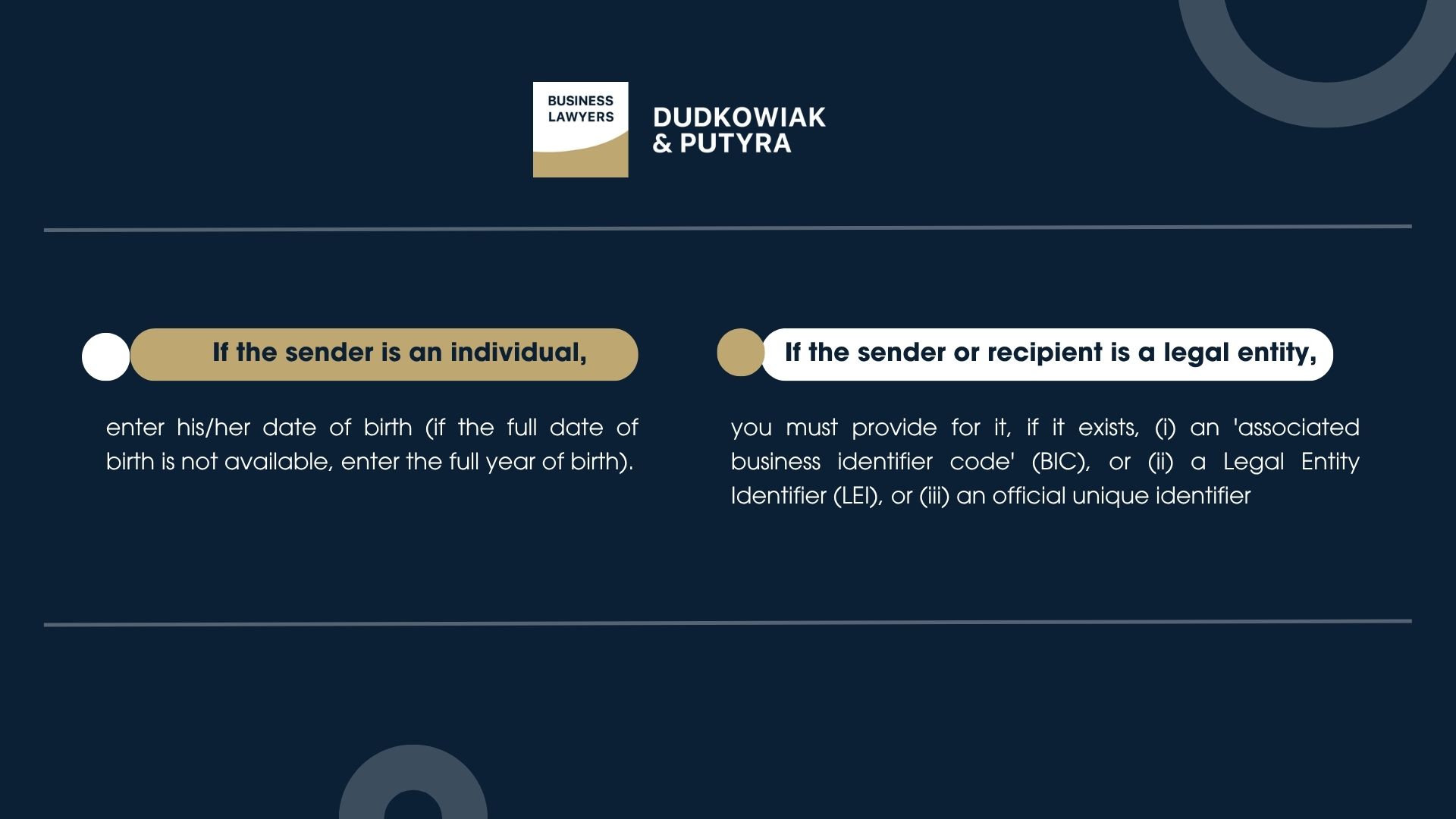

- If the sender is an individual, enter his/her date of birth (if the full date of birth is not available, enter the full year of birth).

- If the sender or recipient is a legal entity, you must provide for it, if it exists, (i) an ‘associated business identifier code’ (BIC), or (ii) a Legal Entity Identifier (LEI), or (iii) an official unique identifier.

Domestic transfers:

- For de minimis and smaller amounts (not more than $1,000/EUR), transactions should include the originator’s name and the originator’s account number, possibly a unique transaction number.

- For amounts above the de minimis ceiling, follow the guidelines for international transfers, unless the beneficiary financial institution and authorities can access this information by other means. The requirement to receive full information from the sender institution within three working days of receiving a request from the intermediary institution, beneficiary institution or authorities has been retained, although the authorities may request such information immediately.

Exceptions and requirements varied:

- For FI2FI transfers, net settlements and batch transactions, no information is needed when the FI-sender and FI-receiver are acting on their own behalf.

- For domestic card withdrawals, no information other than the account number or card number must accompany the card. For international card withdrawals, the cash withdrawal must be accompanied by the card number, and the cardholder’s name should be provided to the acquiring FI upon request within 3 business days. These obligations do not apply to card withdrawals and card purchases of goods and services.

What’s next?

FATF announces issuance of guidelines for implementation of Recommendation 16 in 2026.

The expected implementation date for the updated Recommendation 16 has been set for the end of 2030 at the latest.

Is your organization ready for the updated FATF Recommendation 16?

The revised guidance significantly expands payment transparency requirements – including for domestic transfers. If your financial institution processes payments or handles cross-border transactions, now is the time to assess how these changes may impact your AML and KYC procedures.

Contact our law firm to develop a compliance strategy and reduce regulatory risk well ahead of the 2030 implementation deadline.