Last updated: 09.10.2025

When hiring an employee in Poland, the employer must be aware that he has the responsibility to calculate, deduct and pay social security contributions, as well as tax advances. The costs of these contributions and taxes are shared by both the employer and the employee, in different proportions, which you will read about further in this article.

Social insurance contributions in Poland

The employer is obliged to calculate and remit the social insurance and health insurance contributions on behalf of the employee.

Part of the contributions is deducted from the employee’s gross salary, so it is considered that the employee bears the burden of these costs. The other part of the contributions is additionally paid by the employer, which means that the employer essentially “adds” to the gross amount specified in the contract.

The costs borne by the employee reduce the gross salary, and after these standard deductions, the net salary is calculated. The table below shows which contributions are borne by the employee and employer, and in what amounts.

| Contribution | % borne by Employee | % borne by Employer | Total % of Contributions |

| Pension | 9.76% | 9.76% | 19.52% |

| Disability | 1.50% | 6.50% | 8.00% |

| Sickness | 2.45% | – | 2.45% |

| Accident | – | 0.67% to 3.33% | 0.67% to 3.33% |

| Health Insurance | 9% | – | 9% |

| Employee Capital Plans (PPK) | 2% | 1.50% | 3.50% |

| Labor Fund (FP) | – | 2.45% | 2.45% |

| Guaranteed Employee Benefits Fund (FGŚP) | – | 0.10% | 0.10% |

The health insurance contribution is paid solely by the employee. However, the employer is responsible for calculating it, deducting it from the salary, and remitting it to the Social Insurance Institution (ZUS) on behalf of the employee.

Employee Capital Plans (PPK) in Poland

The Employee Capital Plans (PPK) is a long-term savings program for employees, co-financed by employees, employers, and the state, which allows employees to systematically accumulate savings.

The employer is required to choose an external entity to manage the funds saved by the employee under the PPK scheme.

The employer is obligated to make basic contributions to the PPK amounting to 1.5% of the employee’s salary, while the employee contributes 2% of their salary.

The state adds 240 PLN annually for the employee, and in the first year of joining the PPK, it also contributes a welcome fee of 250 PLN.

Both the employer and the employee can also declare additional contributions. The employer can contribute up to 2.5% of the employee’s salary, while the employee can contribute up to 2% of their salary.

Contributions to the PPK are calculated and deducted by the employer from the employee’s salary, after taxation and social insurance deductions, at the time of salary payment and must be transferred to the financial institution by the 15th of the month following the month in which the contributions were calculated and deducted.

Payroll / Employee Taxes in Poland

Employees who are residents of Poland, meaning individuals who stay in Poland for more than 183 days during the year and/or have their personal and economic interests center (center of vital interests) in Poland, are subject to unlimited tax liability.

This means they are required to pay tax in Poland on their total income, regardless of where the sources of income are located (thus, income earned in a country other than Poland may also be subject to taxation in the territory of the Republic of Poland). This includes income derived from employment contracts, service contracts, and business activities conducted within or outside the territory of Poland.

On the other hand, individuals who do not have their residence in Poland are subject to limited tax liability, meaning they are only liable for tax on income from work performed in Poland under an employment or service contract, regardless of where the salary is paid, as well as other income earned in Poland.

Taxpayer and Withholding Taxpayer in Employment Tax (PIT) in Poland

The legal regulations define who is a taxpayer and who is a withholding taxpayer. According to Article 7 § 1 of the Tax Ordinance Act, a taxpayer is a natural person, legal person, or organizational unit without legal personality, subject to tax liability under tax laws.

A withholding taxpayer is a natural person, legal person, or organizational unit without legal personality, obliged by tax law provisions to calculate, collect the tax from the taxpayer, and remit it to the tax authority within the prescribed time.

The withholding taxpayer is thus an intermediary between the taxpayer and the tax office. In the employment relationship, the taxpayer is the employee, and the withholding taxpayer is the employer.

The employer regularly calculates, collects, and remits advance payments for income tax or lump-sum income tax on behalf of their employees to the tax office.

Therefore, the employer settles not only their own income tax but also the taxes withheld for its employees.

How to calculate the advance payment for Employee Tax in Poland?

When calculating the personal income tax (so called “PIT”) advance payment, the employer must determine the employee’s income for the given month (tax base), then subtract the costs of earning income (PLN 250.00 or PLN 300.00) and the social security contributions deducted from the employee’s salary in that month.

Based on this tax base (rounded to full PLN), the employer calculates the income tax advance according to the tax scale:

- 12% if the employee’s income does not exceed PLN 120,000.00,

- 32% if the income exceeds PLN 120,000.00.

The calculated amount is further reduced by a tax reduction amount (PLN 300.00, PLN 150.00, or PLN 100.00) and rounded to full PLN.

The employer must remit the advance payment to the tax office by the 20th of each month.

If you are still wondering how to calculate your income tax advance payment, we encourage you to use our tax calculator.

Who is exempted from paying the payroll tax advance in Poland?

There are exceptions where the income tax advance is not collected. These exceptions apply to individuals who are exempt from PIT (personal tax) up to PLN 85,528.00. These include:

- young people, students under 26 years of age,

- individuals who moved to Poland after living and working abroad for at least 3 years,

- individuals who exercise parental authority or act as legal guardians of at least four children,

- individuals who remain professionally active despite reaching retirement age and have decided to forgo their pension rights.

Consequences of not paying the PIT employment tax advance in Poland

The Tax Ordinance Act states that entrepreneurs who are withholding taxpayers are responsible for both uncollected tax and collected tax that has not been paid. An employer who fails to collect or remit the income tax advance to the tax office is liable for these amounts with their entire property.

Furthermore, such actions are considered prohibited acts and are subject to criminal tax liability. An exception to these regulations occurs when the tax was not collected due to the taxpayer’s fault and not the withholding taxpayer’s. In such cases, the tax authority issues a decision about the taxpayer’s liability.

An employer who fails to remit the income tax advances on time to the appropriate tax authority is subject to a fine equal to 720 daily rates or imprisonment for up to 3 years, and in extreme cases, both penalties may apply simultaneously.

If the employer does not collect any income tax advances or collects less than they should, they face a fine of up to 720 daily rates or up to 2 years of imprisonment.

However, if the withholding taxpayer pays the full amount of income tax owed to the tax authority before the initiation of proceedings, the above penalties will not apply to them.

As an employer, you must remember to timely remit the income tax advances for your employees to avoid the aforementioned consequences.

Solidarity tax

All Polish residents who earn more than 1 million zł are subject to a solidarity tax of 4% on the excess.

Employment Tax Relief for 2024 and 2025

The table below shows the tax relief employees will be able to take advantage of when settling their income tax for 2024 and 2025.

| Tax Relief | Description | 2024 | 2025 |

| Youth Tax Relief | Exemption from PIT for individuals under 26 years old, with an annual income not exceeding PLN 85,528. | Yes | Yes |

| Child Tax Relief | Tax deduction for parents raising children, depending on the number of children and income (PLN 1,112.04 for the 1st and 2nd child, PLN 2,000.04 for the 3rd child and PLN 2,700.00 for the 4th and subsequent child). | Yes | Yes |

| Rehabilitation Tax Relief | Deduction of expenses related to rehabilitation and the purchase of rehabilitation equipment for individuals with disabilities. | Yes | Yes |

| Internet Tax Relief | Deduction of expenses for using the Internet at the place of residence. | Yes | Yes |

| Thermomodernization Tax Relief | Deduction of expenses for improving the energy efficiency of residential buildings. | Yes | Yes |

| Donation Tax Relief | Deduction of donations made for public benefit, religious purposes, or blood donation. | Yes | Yes |

| IKZE Tax Relief | Deduction of contributions made to the Individual Pension Security Account (IKZE). | Yes | Yes |

| Robotization Tax Relief | Deduction of expenses for purchasing new fixed assets related to the robotization of production processes. | Yes | Yes |

| Working Senior Tax Relief | Tax relief for individuals over 60 years old who continue to work professionally. | Yes | Yes |

| Returnee Tax Relief | Exemption from PIT for individuals returning to Poland after at least 3 years of living abroad, for 4 years. | Yes | Yes |

Additionally, an employee can file jointly with his or her spouse or child, which may also prove to be very beneficial for many taxpayers.

Joint Tax Filing with a Spouse:

- Conditions:

- The spouses must be married for the entire tax year for which they are filing the return.

- Both spouses must have taxable income that is subject to taxation.

- Both spouses must file under the general tax rules (according to the progressive tax scale).

- Benefits:

- Joint filing allows combining the other spouses’ incomes and splitting them in half, which often results in a lower tax liability, especially when one spouse earns less or does not have any income.

- Restrictions:

- Joint filing is not allowed if one of the spouses is exempt from income tax (e.g., benefits from the young worker tax exemption) or is taxed differently (e.g., flat-rate taxation).

For spouses, joint filing taxes can be very beneficial, as it lowers the overall tax liability. The joint tax return must be submitted by both spouses together within the statutory due date for filing annual tax returns.

Joint Filing with a Child (Child Tax Relief):

- Conditions:

- Parents can benefit from the child tax relief by deducting a portion of the income tax. The relief applies if the child meets specific conditions (e.g., age, student status).

- Joint filing with a child applies in cases where the parent is eligible for child tax relief.

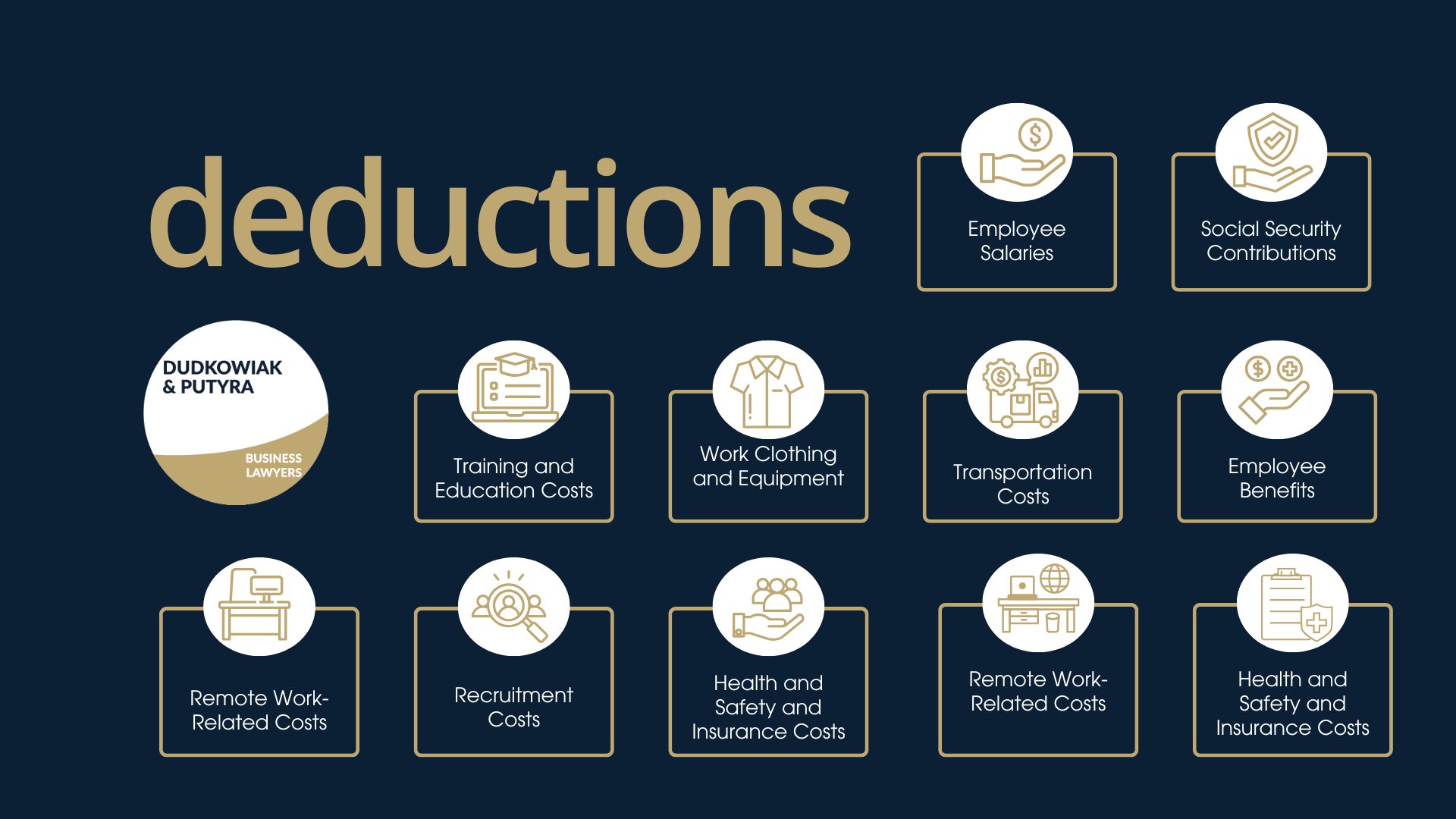

What employment costs are tax-deductible for employers in Poland?

An employer can deduct various employment-related costs from the company’s income tax. Here are some of them:

Employee Salaries

- Salaries paid to employees (wages, bonuses, allowances) are considered deductible expenses.

- The costs of employee sick leave or vacation time are also deductible.

Social Security Contributions

- The employer is responsible for paying social security, health insurance, accident, and Labor Fund contributions for employees.

- These contributions are deductible business expenses.

Training and Education Costs

- Expenses related to employee training and courses, such as paying for professional development or vocational training, are deductible.

- Costs for employees’ higher education or postgraduate studies can also be deducted if they contribute to the employee’s professional development.

Work Clothing and Equipment

- The employer can deduct expenses for purchasing work clothes, protective clothing, or specialized equipment (e.g., tools or computers) that are necessary for the job.

Transportation Costs

- Costs related to employee transportation (e.g., commuting to work or business travel expenses) can be deducted if they are directly related to the work being performed.

Employee Benefits

- Costs for employee benefits, such as meals, social funds, sports cards, group insurance, etc., can be deducted as business expenses.

Recruitment Costs

- Recruitment-related expenses, such as job advertisements, fees for recruitment agencies, can be deducted from income.

Workplace Equipment Costs

- Employers can deduct costs related to equipping employee workstations, such as purchasing office furniture, computer equipment, or necessary software.

Payroll and HR Services Costs

- Costs related to managing employee documentation (e.g., paying for accounting or HR services) are also deductible business expenses.

Remote Work-Related Costs

- If an employee works remotely, the employer can deduct expenses related to providing the necessary conditions for remote work, such as purchasing computer equipment, software, and covering communication costs (e.g., internet).

Health and Safety and Insurance Costs

- Costs related to ensuring compliance with health and safety regulations and providing health and accident insurance for employees can be deducted.

These expenses are an important part of managing taxes for employers, as they can significantly reduce their own tax liabilities. It is crucial for these expenses to be properly documented in order to be recognized as deductible business costs.

Key Takeaways for Foreign Employers in Poland

Foreign employers entering the Polish business sector should seek the guidance of a qualified tax professional to ensure full compliance with state law, payroll regulations, and reporting duties before the local authorities. Observing these rules is particularly important when employing a skilled workforce in Poland, where precise adherence to contribution and filing deadlines is closely monitored by tax and social security institutions.

Employers must remember to meet these obligations regularly and on time to avoid financial penalties and reputational risks.

If you would like to learn more about payroll taxes and contributions under Polish employment law or require assistance in HR and accounting compliance, please contact us at [email protected].

FAQ: Payroll Taxes and Employee Taxes in Poland

What are the payroll taxes in Poland and who is responsible for paying them?

Payroll taxes in Poland include income tax advances and social security contributions paid to the Social Security Authorities and the Labour Fund. Both employers and employees share responsibility for these payments. Employers calculate and transfer contributions based on the total gross salary, applying the applicable contribution rate set by state law.

When is the due date for paying employee tax advances in Poland?

The due date for paying income tax advances is the 20th day of the month following the month in which income is earned. Employers must ensure timely payment, even if the due date falls on public holidays, to remain compliant with local authorities’ regulations.

What is the contribution rate for social and health insurance in Poland?

The contribution rate varies depending on the type of insurance: pension, disability, sickness, accident, and health insurance. For example, the disability insurance rate totals 8%, split between employer and employee. Contributions to the Labour Fund and Employee Capital Plans (PPK) are mandatory for most employers, depending on company size and sector.

Are there any tax-free amounts or benefits available to employees?

Yes. Employees in Poland may benefit from a tax-free amount (up to PLN 30,000 annually) and several tax breaks. Certain categories of income — such as for young employees, parents, or senior workers — qualify for tax-free treatment. These tax benefits help in decreasing tax liability and may result in a lower tax bill.

How do married couples file their taxes in Poland?

Married couples may choose between different tax filing options, depending on their tax filing status. Married filing jointly (a joint return) allows spouses to combine and divide income, often resulting in a lower tax bill.

In certain circumstances, such as when one spouse is a non-resident or legally separated, they may opt for married filing separately or to file separate returns.

What is the tax filing status for non-residents working in Poland?

Non-residents are subject to limited tax liability in Poland. They pay tax only on income derived from work performed in Poland, regardless of where it is paid.

However, residents are taxed on their worldwide income, including earnings from foreign sources. The correct tax filing status depends on marital status, residence, and duration of stay.

What are the key tax brackets for calculating income tax in Poland?

Income tax in Poland is calculated under progressive tax brackets:

- 12% for annual income up to PLN 120,000,

- 32% for income exceeding this threshold.

Taxpayers can also benefit from an amount decreasing tax to further reduce their liability, based on their adjusted gross income and family situation.

Are free or partially paid benefits taxable?

Yes. Free benefits and partially paid benefits (so-called non-monetary or non-cash benefits) are considered part of the employee’s gross income. The total cost or value in kind must be included in income and reported for taxation purposes, following special rules of Polish tax law.

What deductions and tax reliefs are available under Polish law?

Polish taxpayers can apply certain deductions and tax reliefs such as:

- Rehabilitation and medical expenses,

- Internet and donation deductions,

- Tax reliefs for young people and working seniors.

These incentives provide tax benefits and can meaningfully reduce total tax liability.