Tax Changes 2026 – Key Information for Entrepreneurs

Higher VAT exemption threshold from 2026

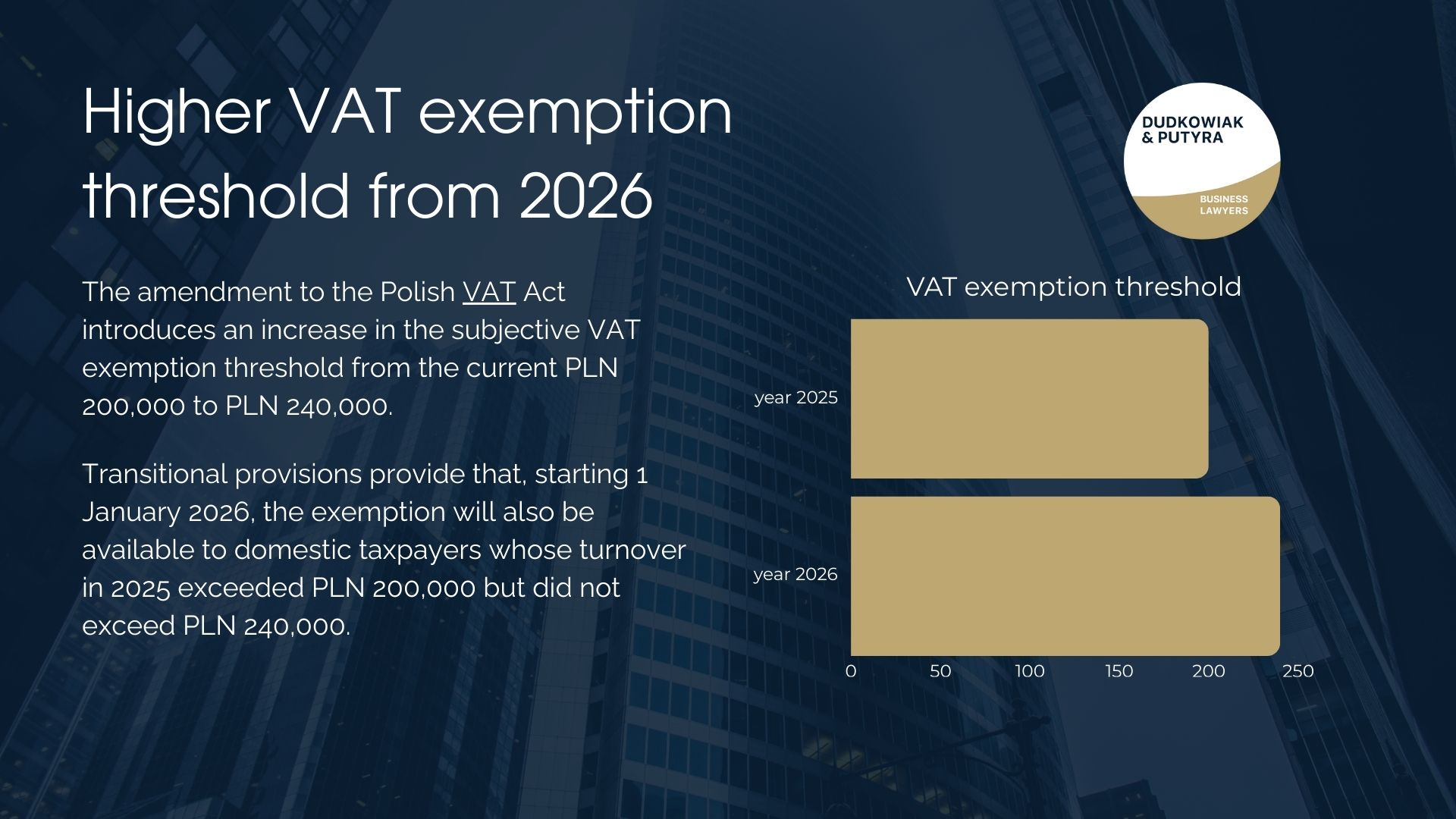

The amendment to the Polish VAT Act introduces an increase in the subjective VAT exemption threshold from the current PLN 200,000 to PLN 240,000.

For taxpayers starting business activity during the tax year, the principle of proportionality will apply – the threshold will be reduced in proportion to the number of days the business is conducted in a given year.

The increased threshold will apply to all taxpayers benefiting from the exemption in Poland – both those with their place of business in Poland and those established in other EU Member States who use the exemption under the SME scheme.

Transitional provisions provide that, starting 1 January 2026, the exemption will also be available to domestic taxpayers whose turnover in 2025 exceeded PLN 200,000 but did not exceed PLN 240,000.

The above regulations will enter into force on 1 January 2026.

End of the obligation to publish a tax strategy

The amendment to the CIT Act repeals Article 27c, which required certain CIT taxpayers to prepare and publish information on their implemented tax strategy for a given tax year.

If the publication deadline falls after the day preceding the amendment’s entry into force, taxpayers will no longer be obliged to prepare or disclose the strategy. Failure to publish the strategy before the changes take effect will not result in a financial penalty. Any administrative proceedings already initiated in this matter will be discontinued.

The amendment also covers the Act on the National Revenue Administration and the VAT Act. Taxpayers subject to a customs and fiscal inspection will be allowed to submit a corrected tax return after the inspection is completed, even if the correction only partially reflects the authority’s findings.

Currently, only corrections fully reflecting the findings of an inspection are permitted. Under the new rules, taxpayers will have 14 days from the initiation or completion of the inspection to submit a correction.

The aim of the amendment is to shorten inspection times and avoid initiating tax proceedings. Additionally, no further late payment interest will accrue if the tax arrears resulting from the correction are paid.

Mandatory KSeF – new deadlines and rules

The amendment introduces the obligation to issue and receive invoices exclusively through the National e-Invoicing System (KSeF).

From 1 February 2026, the system will become mandatory for the largest companies whose turnover in 2024 exceeded PLN 200 million. Other taxpayers will be subject to the obligation from 1 April 2026. Smaller businesses should prepare earlier, as from February they will start receiving invoices from large entities.

Until the end of 2026, the mandatory KSeF will not apply to entrepreneurs with a turnover of up to PLN 10,000 per month. The obligation will also not cover invoices issued by taxpayers who do not have either their registered office or a fixed place of business in Poland.

Taxpayers with a fixed place of business in Poland will also be exempt if that place is not used for the given supply of goods or services. However, a foreign entrepreneur with a fixed place of business in Poland that participates in the transaction will be subject to the obligation.

For a place to be considered a “fixed place of business” within the meaning of Article 44 of Directive 2006/112/EC, the following three conditions must be met:

- possession of technical and personnel resources under the control of the foreign taxpayer;

- conducting business activities on a continuous (non-occasional) basis;

- the ability to make independent decisions locally regarding the supply of goods or services performed from that place.

Penalties and fines

In 2026, penalties will be imposed only in the following cases:

- failure to issue an invoice in KSeF,

- issuing a document inconsistent with the required format during a system outage,

- delay in submitting an invoice to the system.

From 2027, the list of violations will be extended to include, among others, issuing an invoice in software that does not meet KSeF requirements, preparing a document inconsistent with the official schema, or submitting it after the deadline.

Issuing an invoice outside the system may result in a penalty of up to 100% of the VAT amount stated on the invoice, or up to 18.7% of its gross value (if VAT is not shown). The deadline for paying the penalty will be 14 days from the date the decision is delivered.

It is important to note that in KSeF, e-invoices cannot be cancelled. Errors can only be corrected by issuing a corrective invoice.

Changes to MDR reporting from 2026

The amendment to the Tax Ordinance will significantly reduce reporting obligations for tax schemes (MDR) as of 2026.

Attorneys-at-law, advocates, tax advisers, and patent attorneys will be exempt from the obligation to report schemes if the information is protected by professional secrecy. In such cases, they will still be required to inform the client of their own obligation to report the scheme to the Head of the National Revenue Administration (KAS).

The number of domestic tax schemes subject to reporting will be reduced – the obligation will remain only for so-called aggressive tax optimization.

The obligation to file MDR-2 information by the beneficiary and to maintain an internal MDR procedure in the company will be removed.

The amendment will also introduce simplifications and lower penalties. A taxpayer will be able to supplement previously submitted MDR information on their own initiative, not only in response to a request from the authorities.

MDR-3 information on the application of a scheme will be allowed to be filed once a year (instead of after each transaction) and may be signed by an authorized representative.

New opportunity for former partners of partnerships – refund of overpaid tax

The amendment introduces the possibility for former partners of dissolved partnerships – general, limited, professional, and limited joint-stock partnerships – to recover overpaid tax.

Previously, the legislation did not expressly provide for such a possibility.

In the Tax Law section on our website, you will find a comprehensive guide to the Polish tax system – from VAT and CIT to transfer pricing, MDR, and many other topics. If you require assistance with tax matters, please contact us at [email protected].