Last updated: 01.01.2026

What transactions are subject to VAT?

In general, Value Added Tax (VAT) applies to:

- supply of goods and provision of services for consideration within the territory of the country;

- export of goods;

- import of goods into the territory of the country;

- intra- European Union acquisition of goods for consideration within the territory of the country;

- intra- European Union supply of goods.

As a general rule, under Polish regulations, the taxable base comprises everything received or to be received as payment by the supplier of goods or the service provider from the purchaser, the service recipient, or a third party. This includes any subsidies, grants, and similar contributions that directly influence the price of the goods supplied or services rendered by the taxpayer.

Who is considered a VAT taxpayer?

Generally, the taxpayer is any individual, legal person, or organizational unit without legal personality that independently carries out business activities, regardless of the purpose or outcome of those activities.

Under the Polish tax system, there is an additional status known as a “small VAT taxpayer.” This status applies to taxpayers whose total sales (including VAT tax) in the previous tax year did not exceed amount being the equivalent of:

- EUR 2.000.000 or

- EUR 45.000 for taxpayers operating brokerage businesses, managing investment funds, managing alternative investment funds, acting as agents or contractors, or providing similar services, excluding commission-based transactions.

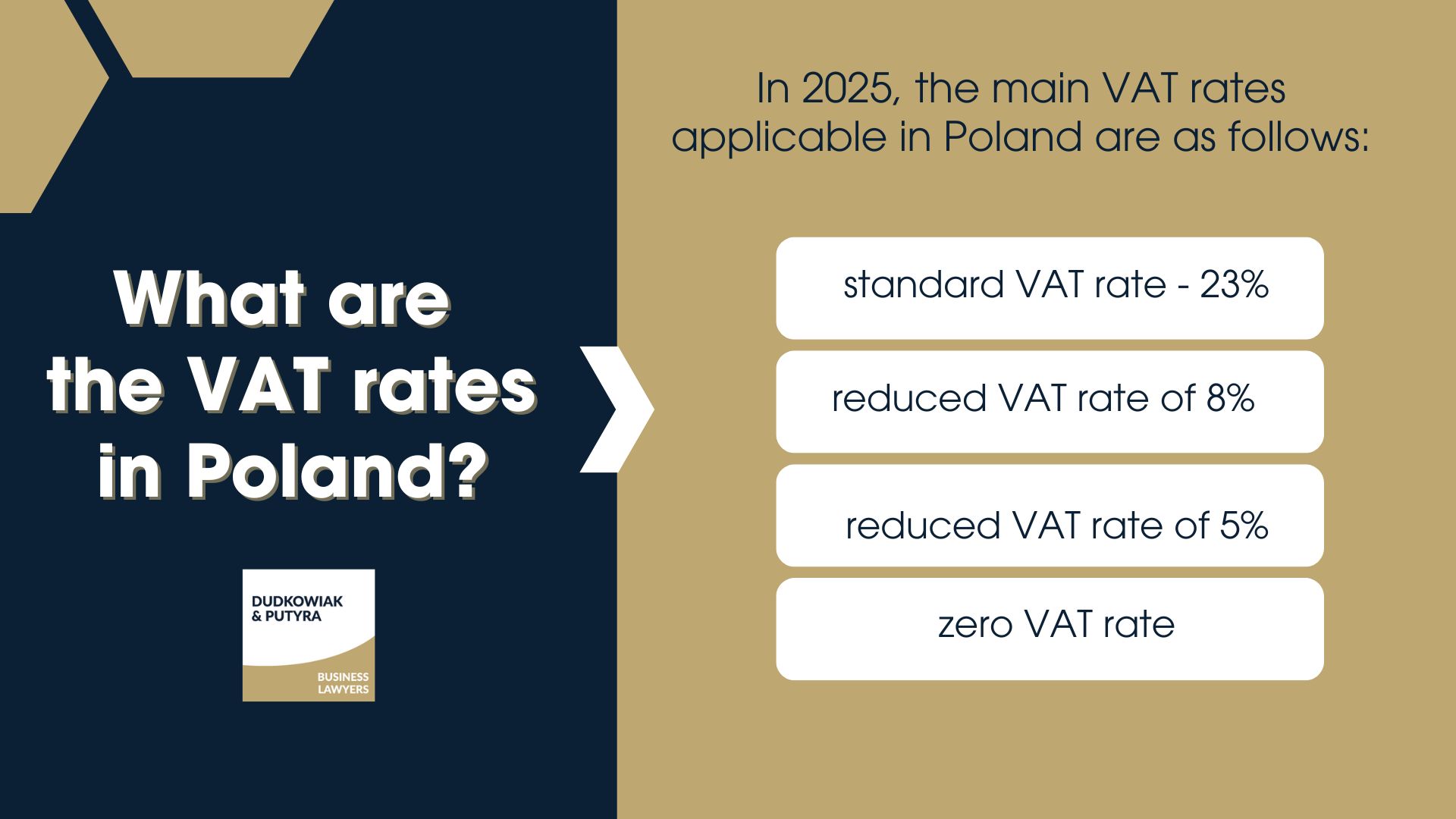

What are the VAT rates in Poland?

In 2026, the main VAT rates applicable in Poland are as follows:

- standard VAT rate – 23%;

- reduced VAT rate of 8% e.g. on residential buildings and certain residential apartments (generally with the area not exceeding 150sqm); medical devices (to be in force only until 27 May 2025, but the Ministry plans to extend this period);services related to culture, sports, recreation or the supply of food products by catering establishments;

- reduced VAT rate of 5% – applied to supplies of certain foodstuffs (e.g. meat, dairy products), but also e.g. books, memory disks, among others;

- zero VAT rate for e.g. rescue vessels and lifeboats that are used at sea and are not seagoing vessels and boats.

VAT exemptions in Poland

Several different types of VAT exemptions are available in Poland.

Subjective exemption – sales made by taxpayers for which the total value of sales did not exceed PLN 200,000 in the previous tax year (the amount of tax is not included in the value of sales) are exempt from VAT.

If the value of sales exceeds the amount of PLN 200,000 during the tax year, the exemption ceases to apply – starting from the activity in which this amount was exceeded.

Objective exemption – applies due to the nature of the business activity, i.e., the sale of goods or services listed in Article 43(1) of the VAT Act, as well as those specified in the Regulation of the Minister of Finance dated December 20, 2013, on exemptions from goods and services tax and the conditions for applying these exemptions.

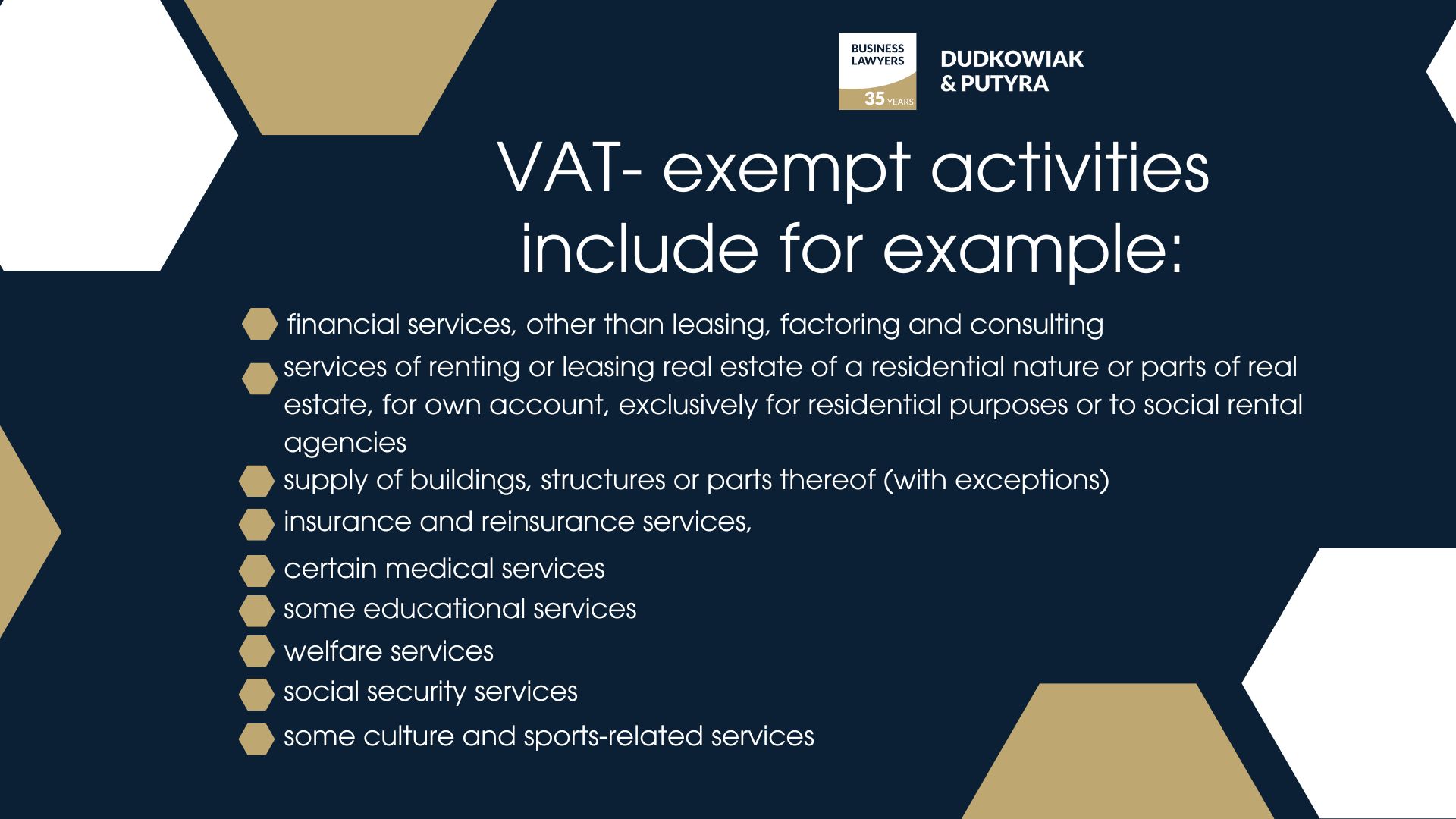

VAT – exempt activities include for example:

- financial services (granting of credits, providing suretyships for financial transactions, money transfers, keeping money accounts, currency exchange, management of investment funds, trading in shares and securities), other than leasing, factoring and consulting,

- services of renting or leasing real estate of a residential nature or parts of real estate, for own account, exclusively for residential purposes or to social rental agencies,

- supply of buildings, structures or parts thereof (with exceptions),

- insurance and reinsurance services,

- certain medical services,

- some educational services,

- welfare services,

- social security services,

- some culture and sports-related services.

VAT registration step by step

Businesses intending to engage in VAT taxable activities in Poland must submit a registration form prior to their first taxable transaction. Additionally, entities planning to conduct intra-European Union transactions are required to complete specialized registration procedures.

A detailed guide on how to set up a business in Poland is available here.

Taxpayers with annual sales not exceeding 200,000 PLN qualify for a VAT exemption designed for small businesses. However, this exemption specifically excludes foreign taxpayers. Businesses retain the option to elect taxation on their sales by providing advance notice to tax authorities.

For VAT registration purposes within Poland, organizations lacking a business establishment, residential address, or permanent establishment in the European Union must designate a tax representative. These appointed representatives bear full responsibility for the tax obligations of the entities they represent.

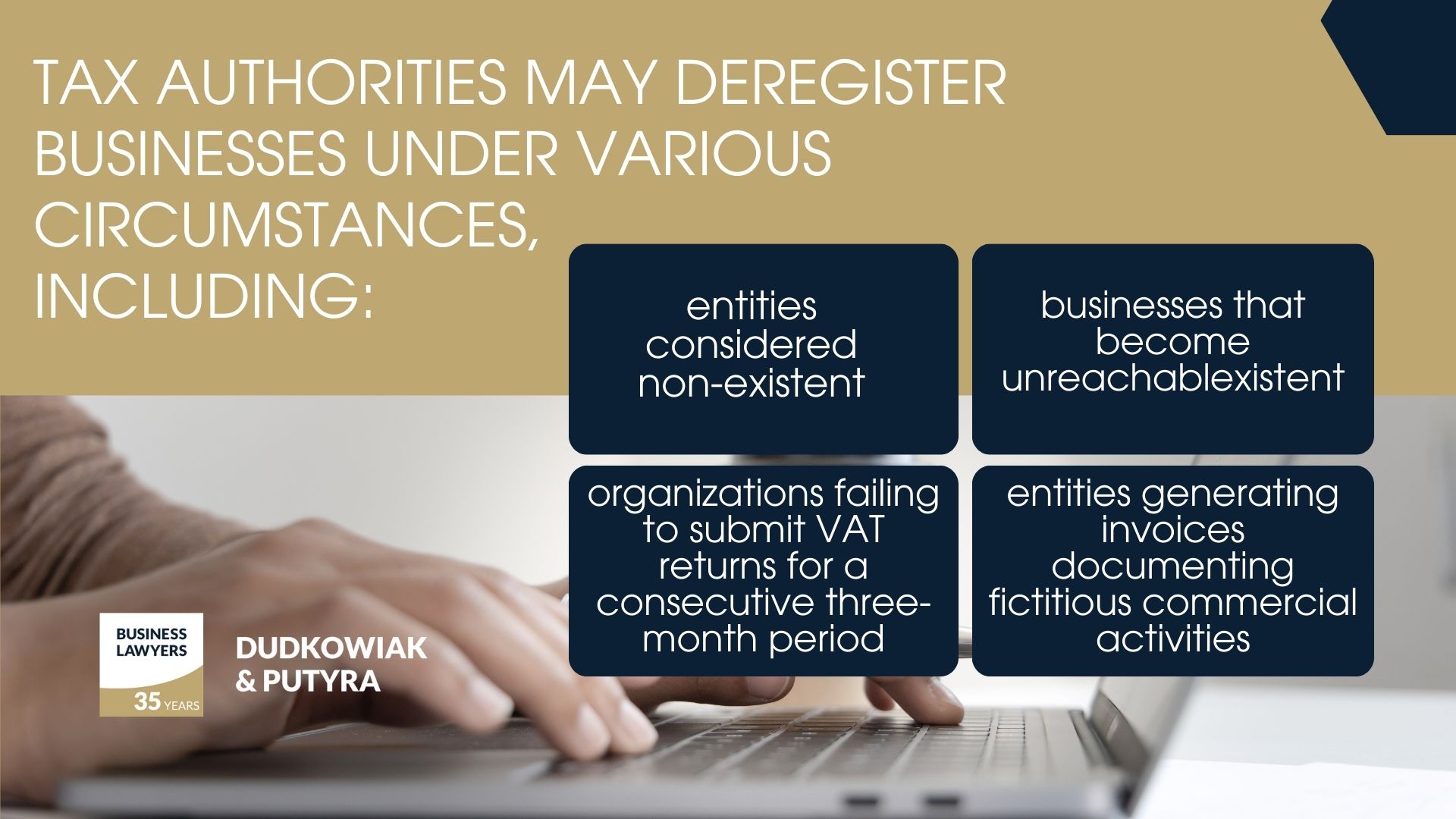

When can authorities deregister a business?

Tax authorities may deregister businesses under various circumstances, including:

- entities considered non-existent;

- businesses that become unreachable;

- organizations failing to submit VAT returns for a consecutive three-month period;

- entities generating invoices documenting fictitious commercial activities.

Effective from 2023, groups of Polish-established enterprises demonstrating substantial financial, economic, and organizational interconnections can apply for registration as a unified VAT group.

VAT-R form – the first step to registering for VAT

In order to register as a VAT payer, a VAT-R form must be submitted to the relevant Tax authorities. The application may be submitted in person, sent by post or submitted electronically.

The foreign entities may be obliged to provide Tax Authority with the additionally following documents and information:

- the Company’s Articles of Association or other relevant document of incorporation;

- the up to date excerpt from the Company’s commercial register (with an apostille clause);

- a sworn translation of all the documents written in a language other than Polish,

- an agreement with a bank confirming the opening of a bank account in Poland, or a declaration that VAT will not be charged (in case the company does not charge input VAT);

- a detailed description of the Company’s activities in Poland, together with a statement as to whether or not the company has a fixed establishment in Poland and whether it has the necessary personnel, technical and office facilities to carry on business;

- documentary evidence of the right to the premises in which the Company operates (in the case of foreign entities, such evidence is not required for premises located in Poland);

- in the case the Company does not registered for the NIP number, the registration process would require the registration to obtain the NIP number.

Competent tax authorities:

| If you are running a business as a legal person or an organizational unit without legal personality (e.g. an association), the documents must be submitted to the tax authority with jurisdiction over the seat of your entity. |

| If you do not have a registered office in Poland, but have a permanent place of business – submit a declaration to the tax authority with jurisdiction over the place of business. |

| If you do not have a registered office or a permanent place of business in Poland – submit a declaration to the Second Tax Authority Warszawa-Śródmieście. |

| If you have a net income of at least EUR 3 million, submit your documents to one of the specialized tax authorities with a provincial scope. |

| If you have a net income of more than EUR 50 million, file your documents with the First Mazovian Tax Authority in Warsaw. |

VAT registration – how long does it take and what does it cost?

There is no legal deadline for the Tax Authority to complete the registration process for the VAT purposes, but in practice it takes up to few weeks to complete the process.

Registration for the VAT purposes is free of charge. However, a written confirmation of registration is subject to PLN 170.

VAT Refunds – How does it work?

If there is a surplus in VAT declaration, company may also apply for a VAT refund.

VAT refund is the companies’ entitlement, from which may or may not take advantage of in the chosen time. Company are also entitled to demand the VAT refund only in a part of the surplus, while the remaining part will be the amount transferred to the next settlement period.

In general, VAT refund shall be made directly to the company bank accounts indicated in connection with their registration.

Which VAT form do you need to claim a VAT refund?

Application for the VAT refund should be made on a “VAT-7” tax return. Please note that the VAT-7 tax return is relevant for monthly settlements period (which is obligatory for every taxpayer within 1 year from VAT registration).

In this case it is irrelevant what type of purchases were made or what the tax rate was applied.

How long does it take to get a VAT refund?

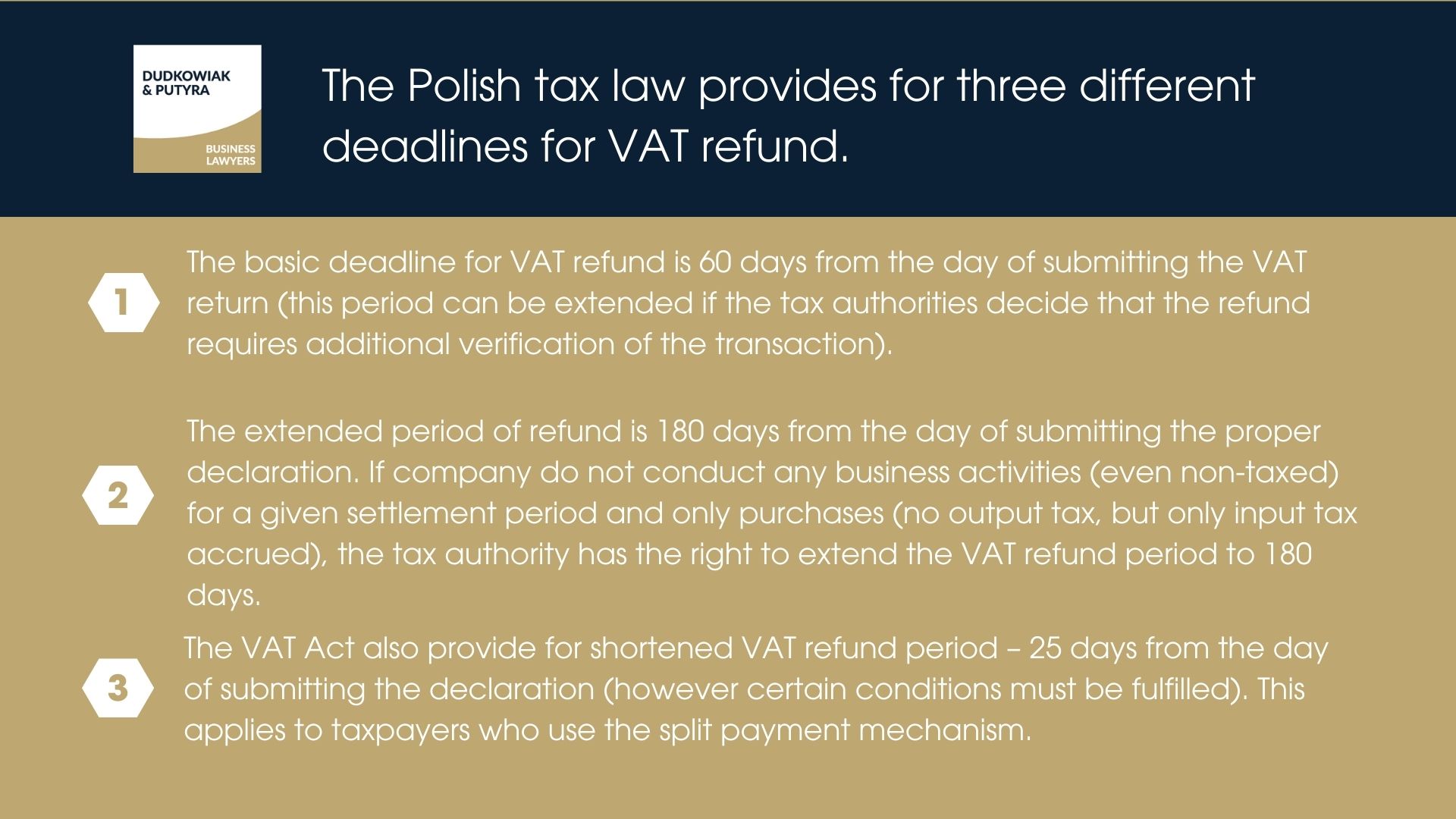

The Polish tax law provides for three different deadlines for VAT refund.

The basic deadline for VAT refund is 60 days from the day of submitting the VAT return (this period can be extended if the tax authorities decide that the refund requires additional verification of the transaction).

The extended period of refund is 180 days from the day of submitting the proper declaration. If company do not conduct any business activities (even non-taxed) for a given settlement period and only purchases (no output tax, but only input tax accrued), the tax authority has the right to extend the VAT refund period to 180 days.

The VAT Act also provide for shortened VAT refund period – 25 days from the day of submitting the declaration (however certain conditions must be fulfilled). This applies to taxpayers who use the split payment mechanism (see below point “Split payment”).

Split Payment mechanism – a tool for VAT compliance

The split payment mechanism (split payment, consists in the fact that the payment for goods or services, made by the buyer by a special transfer – the so-called “transfer message”, does not go in its entirety to the recipient’s account, but is divided into the net amount and VAT.

The net amount goes to the seller’s account and the VAT amount goes to his VAT account.

A VAT account is created automatically by the bank, as an additional account, to any account set up in connection with your business , i.e. your checking account at the bank or SKOK.

How does split payment impact VAT refunds?

In the case of VAT refunds, the 25 days period is also used in connection with the refunds made on the split-payment VAT bank accounts within the split payment mechanism (however, these funds can be used only to VAT-related settlements, such as payment of VAT to the counterparty’s VAT bank account or payment of output VAT due in the next settlement periods to the tax authority).

It is worth to note that the funds located on the split-payment VAT bank account can also be released into the general taxpayer bank account, nevertheless the period for such refund is 60 days and taxpayers need to submit a relevant application for such release.

Transactions subject to split payment

Payments using the split payment mechanism will apply to transactions which are subject to VAT in Poland, are made between taxpayers (B2B), with a one-off value exceeding PLN 15,000 (regardless of the number of payments resulting from the transaction).

The obligation to use the split payment mechanism will cover selected goods and services.

In general, the following groups of goods and services can be distinguished:

- building and constructions services;

- steel products, precious metals, non-ferrous metals;

- waste, scrap, recyclable materials;

- electronics, specifically: processors, smartphones, phones, tablets, net-books, laptops, game consoles, inks, toners, hard drives;

- fuels for cars, fuel and lubricating oils;

- greenhouse gas emission rights;

- coal;

- sale of car and motorcycle parts.

VAT reporting – deadlines and requirements explained

Taxpayers submit monthly VAT returns by the 25th of the following month, or they may file quarterly VAT returns using SAF-T (JPK_V7), also by the 25th of the subsequent month. However, the quarterly filing option is only available to “small taxpayers” with annual turnover under EUR 2 million.

VAT returns and recapitulative statements are filed electronically. As a rule, VAT liable is paid to the tax authority at the time of filing an appropriate VAT return.

What is the VAT taxpayers’ white list?

Since September 1, 2019, the VAT taxpayers’ white list has been in effect. It serves as a register that includes taxpayers registered as active VAT payers, as well as those who are unregistered or exempt from VAT. It also covers taxpayers who have been removed from the register and subsequently reinstated.

We can use it via the website of the Ministry of Finance.

The primary purpose of the white list, maintained in the form of a register, is to enable the verification of a contractor’s bank account. It also facilitates checking the VAT taxpayer status and provides information on the dates of removal from and reinstatement to the VAT register.

What details are listed on the VAT white list?

Among the available information, the following should be included:

- company name or entrepreneur’s first and last name;

- the number used to identify the entity for tax purposes, if such a number has been assigned;

- entity status (“active VAT taxpayer”, “VAT-exempt taxpayer”, including information about entities whose registration has been restored);

- REGON number or KRS number (if assigned);

- registered office address;

- first and last names of persons comprising the body authorized to represent the entity and their tax identification numbers;

- first and last names of proxies and their tax identification numbers;

- dates of registration, registration refusal, or deletion from the register, as well as restoration of VAT taxpayer status;

- legal basis for registration refusal, deletion from the register, or restoration of VAT taxpayer status;

- settlement account numbers in a bank or nominal accounts in a cooperative savings and credit union.

Sanctions for using an account not appearing on the White List

The absence of a bank account on the White List can result in significant consequences for both the payer and the recipient of the payment. The implications include:

- Loss of the right to recognize expenses as tax-deductible costs: if a payment exceeding PLN 15,000 is made to an account not listed on the White List, the payer cannot classify this expense as a tax-deductible cost in their tax return;

- Joint liability for the VAT obligations of the counterparty: a taxpayer who transfers funds to an account not included on the White List may be held jointly liable for the counterparty’s VAT arrears if the latter fails to pay the VAT due to the tax authority. To avoid such consequences, the taxpayer must notify the relevant tax authority within seven days of the payment date by submitting a ZAW-NR form. Taxpayers can also avoid the indicated consequences if e.g. they make the payment using the split payment mechanism.

- Potential loss of VAT deduction rights: taxpayers are entitled to deduct input VAT on goods and services used for taxable activities. To exercise this right, taxpayer must demonstrate due diligence. One of the elements of due diligence in domestic transactions is verifying business partners against the White List. Failure to conduct such a verification may result in a loss of the right to deduct VAT – however, in practice, such a loss of right to deduct VAT is not very common and may occur only in specific situations.

FAQ – Value added tax and polish VAT rates

What is Value Added Tax (VAT)?

Value Added Tax (VAT) is an indirect tax levied on the supply of goods, provision of services, importation of goods, and intra-European Union transactions. It is a consumption tax added to the final price of goods and services.

What are the VAT rates in Poland?

In 2026, the VAT rates in Poland are:

- Standard VAT rate: 23%.

- Reduced VAT rates:

- 8% for specific services and goods, such as residential buildings, medical devices, and cultural services.

- 5% for certain foodstuffs, books, and electronic items like memory disks.

- 0% for select rescue vessels and other specific items.

How does VAT registration work in Poland?

Businesses engaging in taxable activities must register for VAT before their first taxable transaction. Foreign businesses without an EU establishment must appoint a tax representative. Registration involves submitting the VAT-R form and required documentation to the appropriate Polish tax authorities.

What is a VAT refund, and how can it be claimed?

Businesses may apply for a VAT refund when input VAT exceeds output VAT. Refund applications are submitted with a VAT-7 return, and the standard refund period is 60 days. Shortened periods, such as 25 days, may apply under certain conditions like using the split payment mechanism.

What exemptions apply under Polish VAT law?

Polish VAT law includes subjective exemptions for businesses with sales under PLN 200,000 annually and objective exemptions for specific activities, such as financial, medical, and educational services. Exemptions also apply to some cultural and sports-related services.

What is the split payment mechanism for VAT?

The split payment mechanism divides payments into net and VAT components. The VAT amount is deposited into a special VAT account used exclusively for VAT-related transactions, ensuring compliance and reducing the risk of VAT fraud.

What are the VAT obligations for businesses in Poland?

Businesses operating in Poland must comply with VAT obligations, including registering for VAT, issuing invoices with the appropriate VAT rate, submitting VAT returns, and remitting VAT to the tax office. These obligations help ensure proper collection of tax revenue under the Polish VAT system.

How does VAT impact goods and services sold in Poland?

VAT applies to most goods and services sold in Poland, influencing their final price. Depending on the taxable goods or services, different VAT rates (standard or reduced) may apply as outlined in the Polish VAT Act. Some goods and services may qualify for VAT exemptions or zero rates under specific conditions.

How does the Polish VAT system prevent VAT fraud?

The Polish VAT system includes mechanisms such as the split payment system, mandatory electronic VAT returns, and the VAT taxpayers’ white list to enhance transparency and reduce VAT fraud. By ensuring accurate reporting and proper procedures for paying VAT, these measures protect government revenue and support compliance across the sales tax system.