Coinbase Europe Hit with €21.5M Fine: Key Lessons for Crypto Fintechs

On 6 November 2025, the Central Bank of Ireland (CBI) fined Coinbase Europe Limited €21,464,734 for breaching transaction-monitoring obligations under Ireland’s AML/CFT law – the first major Irish enforcement in the crypto sector and a clear reminder that crypto compliance is now bank-grade.

Case study: what the CBI found

Configuration errors in Coinbase Europe’s transaction monitoring system resulted in over 30 million transactions (around 31%, worth €176+ billion) not being properly monitored over a 12-month period. The review process took nearly three years and led to 2,708 Suspicious Transaction Reports (STRs) being submitted to the FIU.

The Settlement Notice indicates 30,442,437 transactions that are not monitored and 184,790 that require additional enhanced monitoring; the remediation resulted in 255,125 alerts and ultimately 2,708 STRs, with a total value exceeding €13 million.

Coinbase admitted the violations and accepted the penalty. The initial fine of €30,663,906 was reduced by 30% under the settlement scheme to €21,464,734. As CBI’s Deputy Governor warned, a failure of a monitoring system “creates an opportunity for criminals to evade detection” – therefore, the regulator maintains a firm stance.

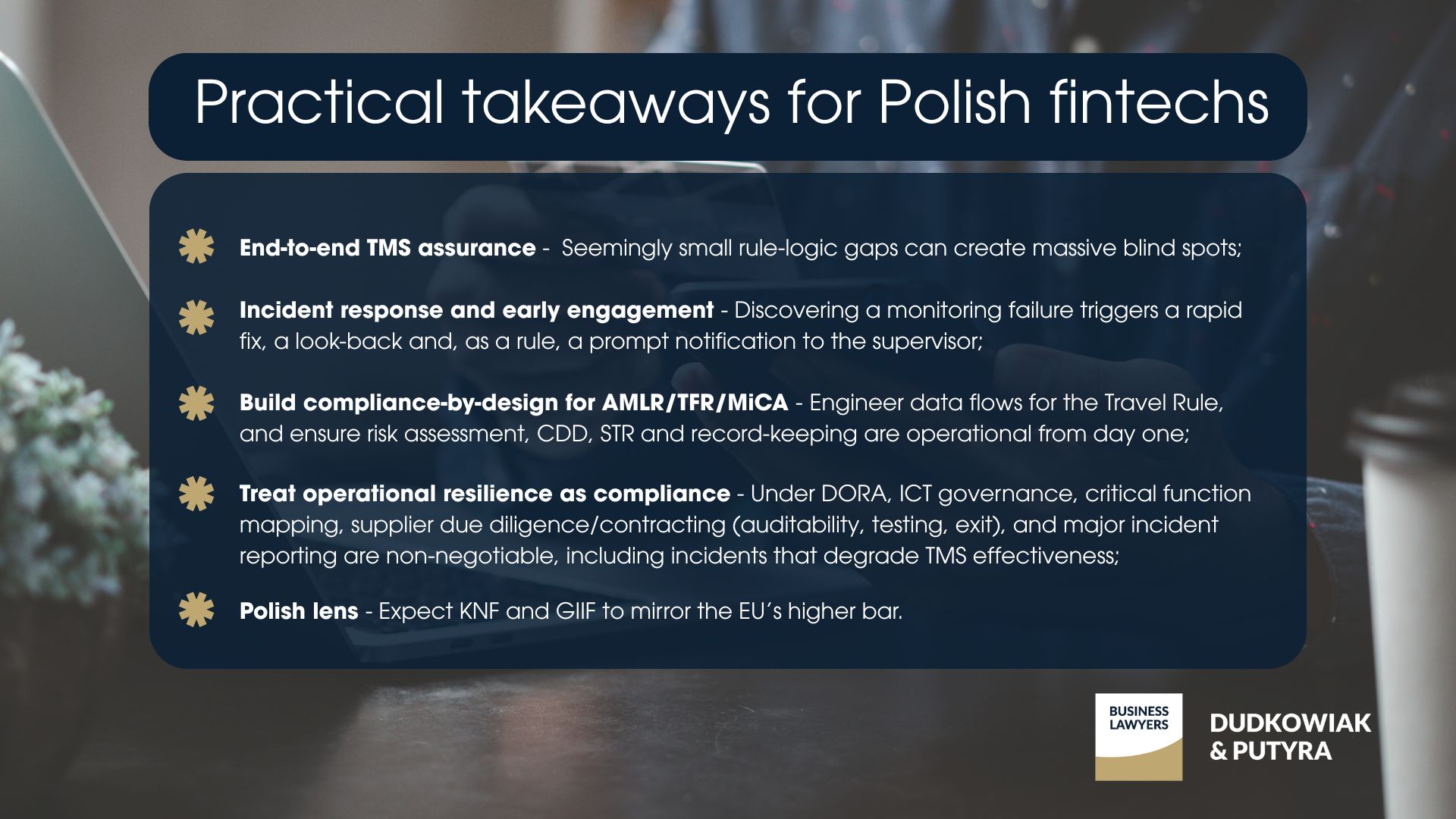

Practical takeaways for Polish fintechs

End-to-end TMS assurance.

Seemingly small rule-logic gaps can create massive blind spots. Treat TMS updates as regulated change: regression testing, scenario/model validation and code review, all evidenced for inspection. The CBI viewed the absence of full monitoring (30+ million transactions) as a standalone serious breach.

Incident response and early engagement.

Discovering a monitoring failure triggers a rapid fix, a look-back and, as a rule, a prompt notification to the supervisor. Delay was an aggravating factor in Coinbase’s case.

Build compliance-by-design for AMLR/TFR/MiCA.

Engineer data flows for the Travel Rule, and ensure risk assessment, CDD, STR and record-keeping are operational from day one; remember that CASP authorisation and its maintenance hinge on AML/CFT programme quality and cooperation with FIUs.

Treat operational resilience as compliance.

Under DORA, ICT governance, critical function mapping, supplier due diligence/contracting (auditability, testing, exit), and major incident reporting are non-negotiable, including incidents that degrade TMS effectiveness.

Polish lens.

Expect KNF and GIIF to mirror the EU’s higher bar. Investing in AML specialists, blockchain analytics and a strong compliance culture is best viewed as insurance against financial and reputational loss from enforcement.

Don’t Be the Next €21.5M Headline: Fix Your AML Now

The Coinbase Europe case shows one thing: weak AML and compliance are no longer tolerated in the EU. With AMLR, MiCA and DORA raising the bar, fintechs must level up fast.

We help crypto firms build strong AML frameworks, test monitoring systems and secure CASP authorisations. Want to avoid a €21.5M mistake? Contact us – we’ll make your compliance future-proof.