Home / Author blogposts

Investor zone:

Copyrights Regulation in Poland

Gambling Laws

Trademark in Poland

Copyrights Regulation in Poland

Gambling Laws

Trademark in Poland

Company Liquidation in Poland

Shareholders Meeting in Poland

Shareholders resolutions in Poland

Board of Directors in Poland

Conveying Shareholders Meeting

Dismissing Director in Poland

Liability of Directors in Poland

Share capital increase in Poland

Share capital in LLC in Poland

Reduction of share capital in Poland

Supervisory Board in Poland

Auditing Committee in Poland

Taxation of Polish Company

Accountancy in Polish Company

Changes in the supervisory board in Poland

Foundation registration in Poland

Transformation into Joint Stock Company in Poland

UBO / Ultimate Beneficial Owner in Poland

All Practices

Companies & corporate law

M&A

Contracts

Employment

Litigation & Arbitration

Debt collection

Intelectual property

Antitrust & competition law

Personal data protection

Administrative law

Regulatory

Public procurement

Copyrights

Tax advisory

Inheritance law

Consumer protection

Divorce

Criminal law

Conveyancing

Immigration law

Notary Services

-

Investor zone

- Go back

- Environment Law in Poland

- Regulatory in Poland

- Invest in Poland

- Employment Law in Poland

- Taxes in Poland

- M&A in Poland

- Company incorporation in Poland

-

Corporate Law in Poland

- Go back

- Corporate Law in Poland

- Company Liquidation in Poland

- Shareholders Meeting in Poland

- Shareholders resolutions in Poland

- Board of Directors in Poland

- Conveying Shareholders Meeting

- Dismissing Director in Poland

- Liability of Directors in Poland

- Share capital increase in Poland

- Share capital in LLC in Poland

- Reduction of share capital in Poland

- Supervisory Board in Poland

- Auditing Committee in Poland

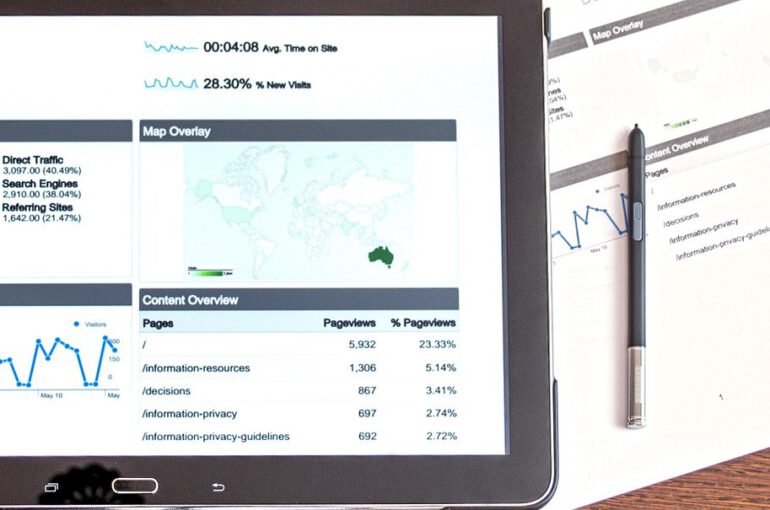

- Taxation of Polish Company

- Accountancy in Polish Company

- Changes in the supervisory board in Poland

- Foundation registration in Poland

- Transformation into Joint Stock Company in Poland

- UBO / Ultimate Beneficial Owner in Poland

- Litigation in Poland

- Debt Collection in Poland

- Criminal law in Poland

- Antitrust / Competition Law

- Immigration Law in Poland

- Property purchase in Poland

- Copyrights Regulation in Poland

- Inheritance in Poland

- Fintech in Poland

- Gambling Laws

- Trademark in Poland

- Industries

-

Practices

- Go back

- Companies & corporate law

- M&A

- Contracts

- Employment

- Litigation & Arbitration

- Debt collection

- Intelectual property

- Antitrust & competition law

- Personal data protection

- Administrative law

- Regulatory

- Public procurement

- Copyrights

- Tax advisory

- Inheritance law

- Consumer protection

- Divorce

- Criminal law

- Conveyancing

- Immigration law

- Notary Services

- Accounting

- Payroll

- Team

- Contact

- News

- About us

- Case study

- History

- Local services

- Career

- Cookies policy